Why is the Internet revolutionary and relevant to this day? Because it optimizes possibilities in the Web 2 space. In the financial sector, the Internet allows interconnectivity empowering financial transactions. Similarly, in gaming, it allows scalability to stimulate participation; whereas, in the music industry, it allows inclusivity because anyone can upload their music and make it available for use.

Likewise, Elastic Chain(s) of Zksync is an equivalent revolutionary technology like the Internet in the Web 3 space because it is solving the many problems of the Web 3 space like interoperability, scalability, decentralization and privacy. As a result, different sectors, which had otherwise remained bloated due to technological incompetence can foresee new possibilities now.

In this piece, we shall see how ZKsync’s Elastic Chain(s) are helping different sectors scale new use-cases by their deployment.

What are ZKsync’s Elastic Chains?

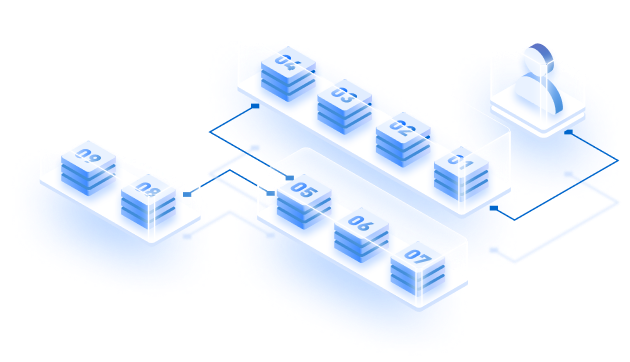

ZKsync’s Elastic Chain(s) are a network of interconnected chains in the ZKsync ecosystem that feels like a single chain, which is infinitely extensible and it is secured by math and at the sametime highly interoperable with a standard UX design.

How ZKsync’s Elastic Chain(s) Are Benefitting Different Sectors In the Web 3 Space?

DeFi

We have often heard the narrative that DeFi’s potential is to bank the unbanked. With that being said, one can imagine that there would be a multitude of Dapps providing the opportunity of staking, farming, borrowings and payments. However, if all of these Dapps demand the complexities of managing the private keys, demanding bridging, payment in high gas for cross-dapp interaction and requiring different wallets for interaction with different protocols and inability to provide privacy, it would defeat the purpose of providing a seamless banking experience. That’s where ZKsync’s Elastic Chain(s) provide an advantage.

Dapps built using ZKsync’s ZK Stack creates a robust aggregation layer through the ZK Gateway and ZK Router for native and non-native chain interaction. So, users do not have to maintain separate wallets and use bridges for payments and cross protocol interaction. In addition to this, the Zero Knowledge nature of data sharing maintains the privacy of the users. These trade-offs have allowed exchanges like GRVT to launch numerous use-cases like options and perpetual futures trading on their Elastic Chain(s) because it removes the complexities of cross-bridging and accessing different ecosystems seamlessly that have so far plagued the UX on DeFi. Through the use of ZKsync’s Elastic Chain(s), GRVT is able to provide scalability, on-chain data privacy, self-custody support, high TPS for faster settlement and clearing, seamless interoperability and top-tier security to help new use-cases emerge and help people.

Now, if GRVT wanted to do this for their options and perpetual futures trading, where they wanted to provide scalability, privacy, security, and interoperability cross-chain sans ZK Stack, it would have been ideally computationally expensive to achieve. But Elastic Chain(s) simply take away all these hassles and GRVT now, not only achieves 600,000 trades per second with less than 2 milliseconds of latency, but also provides privacy in the process because margin balances and liquidations remain hidden from the view of the users by using validiums on Elastic Chain(s).

Gaming

According to the Dapp Radar report, blockchain gaming has hit a new high of 1.9 million daily unique active wallets (dUAW), signaling a 28% all Dapp activity attributed to gaming. However, one striking thing to note is player experience has gone for a toss. For example, in a Web3 game, the player has to create a new wallet every time they wish to interact with a game. Comparing the same with a Web 2 game, there’s no such inefficiencies involved. Hence making Web 3 onboarding experience complex.

Elastic Chain(s) built using the ZKsync’s ZK Stack completely abstracts all of these inefficiencies. Developers can introduce consumer oriented functionalities like Native Account Abstraction(NAA) and Paymaster Smart-contracts which can simplify the onboarding process. In addition to this, they can also define their own scalability requirements. For example, Tavaera, a gaming ecosystem that wants to mirror a Web 2 gaming experience on Web3 chose ZKsync’s ZK Stack to launch their Elastic Chain because they wanted a disruptive innovation and through Elastic Chain, they could introduce hyper scalability, subtract functionalities through optimized cost profile for in-game transaction.

Which means, while players are playing their games, there’s an inward account that is incurring the cost of the transactions that they initiate within the game environment. So, in a way, it almost looks like a typical Web 2 gaming ecosystem and ZK sync’s allow you to create a Paymaster account using ZyFi, which is a gas abstraction layer on the ZKsync Network for the game developers. In this way, the games can abstract majority of the functions and allow new use-cases to emerge like minting new NFTs in a different game environment or transferring NFTs seamlessly without incurring high gas fees for gamers.

Like Tavaera, StarDust is using ZKsync’s Elastic Chain(s) to bolster their specific use-cases. For example, StarDust is using the NAA of ZKsync’s ZK Stack to launch their Elastic Chain(s) where the users need not have to use the complexities of handling the wallets, on the contrary, everything can be handled at the backend by the protocol itself, while the users are having a fulfilled gaming experience.

RWA Tokenization

As we already know that TVA or Total Value Locked defines the success of DeFi. However, in the past couple of months, we have seen a negative outlook of DeFi due to dwindling NFT trends, protocol hacks and over-hyped concepts like the Metaverse. But RWAs have undoubtedly shown an optimistic way forward to help DeFi stand again. At the time of writing, the TVL on DeFi has jumped from $54.4 billion to $84.511b as per DeFiLama. The credit goes to the derivative market and private financing which has grown to $600 M and could soon touch $1.4 Trillion (T).

But such a spike in adoption demands decentralization, scalability, security and regulations to occur simultaneously while introducing the RWAs. As a result, a technology stack that can guarantee frictionless market access, innovative tools, and investment strategies to occur without diluting the sovereignty of operations and keeping regulations in check could help scale the sector to new heights.

ZKsync’s Elastic Chain(s) have been really helpful in this regard. Tradable , an institutional grade private credit platform has been launching their platform using the ZK Stack because it allows Tradable to enjoy the ability to build their own bespoke blockchains with high throughput and at the same time, maintain personalized privacy control, data management and transaction protocol while inheriting the security and the liquidity of the Ethereum ecosystem for their use-cases specific solutions. In this way, regular users will be able to get access to institutional grade deals via an easily accessible marketplace which is built using the ZK Stack to meet the growing needs of the users. And Tradable will be able to build a completely custom robust ecosystem which will be highly liquid, interoperable and compliant in all capacity.

Payment/Remittance Industry

Fee payment while sending a transaction has been an offsetter for enterprises who wish to launch on top of a blockchain. For context, imagine Alice sending $100 to Bob and Bob receiving only $90 or $99. Someone would adjust with $99 but if it is $90, that’s a pressing concern. On the Bitcoin Network, users are paying as high as $28 for a transaction during peak hours. Whereas, on Ethereum, the condition is slightly better but not the best at 0.7922 USD/tx. Comparing the same with a transaction on Venmo, a payment app of the US and PhonePe, a payment app of India, the user has to incur no cost at all for sending payments.

But ZKsync through its Elastic Chain(s) is completely rewriting the narrative. The ecosystem is making transactions in equivalence with what Venmo and PhonePe is doing. For example, the Zerion ecosystem through the use of the ZK Stack is bringing Native Account Abstraction on Zero. The smart contracts and Paymasters can help Dapps perform specific functions, like signature schemes, spending caps, multi-sig features, and app-specific restrictions like abstracting gas payments. So, it is even possible to either completely write-off the gas payments or allow the users to pay in any token for the gas. Zerion is using the Flywheel technique to achieve the same for gas payments and allegiance to ZKsync’s ZK Stack that makes this possible through account abstraction where Zerion Revenue Vault will come into play to pay for the additional gas during peak hours. In this way, it completely abstracts the gas payments and makes the platform suitable for sustainable usage.

Enterprise applications

Enterprises have been facing stricter challenges when they want to deploy on top of a blockchain stack, which is public because they have to share the network with noisy neighbors and make sensitive data public. But Elastic Chain(s) have completely rewritten possibilities where bespoke configuration is possible, which is not only scalable but customizable at the same time. Creator, a scalable blockchain platform is doing the same for digital economies using the ZK Stack to launch their Elastic Chain(s) which will aid in the creation and execution of UGC or User Generated Content.

Customization drove Creator towards ZKsync’s Elastic Chains because they were not only able to amplify the UX but even allow the users to tap into a wider liquidity base. At the moment, enterprises are vying for access to a wider ecosystem which is easily commutative and easily accessible on their own terms. Elastic Chain(s) have readily guaranteed the same to enterprises driving them to build specific use-cases without getting weighted down by technology bottlenecks.

Setting Up Your ZKsync Elastic Chain with Zeeve RaaS

Zeeve’s Rollups-as-a-Service has been customized in such a way that no matter which sector you represent, you can easily set-up your use-cases specific ZKsync Elastic Chain(s). Zeeve has the necessary technology and the infrastructure support , along with seasoned experts, who can help you set-up your own custom Elastic Chain(s). Businesses can set up their ZKsync Elastic chain testnet in minutes using Zeeve’s sandbox tool. Along with this, you also get the benefit of on-boarding 40+ integration partners to your Elastic Chain(s) who can further bolster the specific requirements of your use-cases that you want to build on top of the Elastic chain.

To get more information about what we do and how we can help you set-up your Elastic Chain(s) in a completely friction free manner, you can talk to our experts via call or email.