Bitcoin and Ethereum were the first blockchains that broke through to the mainstream. Little did anyone know in 2009 speed, scalability, cross-chain transaction, and other factors would limit said blockchains from reaching their full potential.

Simply not designed for widespread adoption, many L1 and L2 companies mushroomed to address scalability and speed-related issues, which paved the way for newer problems. Soon enough, the blockchain community learned that there was no means for the blockchains to talk to each other, and assets within them were siloed. This is where cross-chain bridges come to the rescue.

What is a cross-chain bridge?

A cross-chain bridge is essentially a bridge between two different blockchains that enables the transaction of assets and information between the two. Cross-chain bridges are necessary as assets and data are siloed within the blockchain, unable to communicate with a different blockchain. To explain this simpler, imagine being stuck in a big metropolitan city like New York with no means to commute to any other city. This is precisely what’s happening with the Ethereum blockchain currently.

As of now, if you have funds on Ethereum (ETH) and want to migrate them to Polygon, the best bet way to do so is converting ETH to MATIC (Polygon’s cryptocurrency) with the help of CEX like Binance or Coinbase.

When a cross-chain bridge is built between two or more blockchains, as depicted in the image below, you may transfer funds and lend, swap, deposit, and stake assets seamlessly between any blockchain. This is known as blockchain interoperability.

Why do you need a cross-chain bridge?

There are three main reasons why cross-chain bridges are important. To enable a better user experience (UX), better asset productivity, and transacting liquidity for decentralized apps (dApps).

Better UX

Without a doubt, Ethereum was, and for the most part, still is, the go-to platform for many developers and businesses to build dApps. Although Ethereum offers high-grade decentralization devoid of security issues and censorship, it comes with tradeoffs like slow transaction speeds, and high gas fees, which directly affect the dApp user experience.

To remedy this, newer blockchains like Polygon, Arbitrum, and others offer cheaper gas fees, higher network throughput, richer UX, and cross-chain bridges that can improve this process.

When users can directly transact between Ethereum and Polygon, for instance, they can enjoy the benefits of both worlds, whilst engaged in a beautiful user experience.

Better asset productivity

In the last few years, decentralized finance (DeFi) has gained momentum as it offers better means of generating passive income as opposed to hoarding cryptocurrencies in your wallets.

Staking, lending, and yield farming offer substantial interest rates for users, along with many other benefits and cross-chain bridges can turn this into an even better prospect.

When you can use your Bitcoin (BTC) as collateral on the Ethereum blockchain for wBTC (wrapped bitcoin), you can earn extra value on your BTC, which is otherwise left dormant in your wallet.

Transacting liquidity for dApps

For a developer or a business, having a large on-chain liquidity pool is critical for the usage and growth of their dApps but many new Ethereum and Bitcoin alternatives provide lower usage and liquidity.

In this scenario, cross-chain bridges enable dApp devs to tap into the liquidity available on different blockchain platforms, maximizing the liquidity for said dApps.

How do cross-chain bridges work?

The “Lock & Mint” and “Burn & Release” models are used by most cross-chain bridges, and here’s how they work.

For instance, let’s consider Chain 1 as one blockchain network and Chain 2 as another blockchain network.

In the Lock & Mint method, a bridge can be developed to lock a certain number of tokens on Chain 1 and mint new ones on Chain 2. For example, if Chain 1 had 100 tokens and transferred 50 of those tokens to Chain 2, Chain 1 would still show 100 tokens but 50 out of that would be locked, and 50 tokens would (be mint) now appear on Chain 2.

The owner of newly minted 50 tokens on Chain 2 can decide to redeem them or “burn” them from Chain 2, or take a call to “release” or unlock them completely from Chain 1. This is known as the Burn & Release method.

Both the models/methods ensure that the quantity and the cost of the tokens transferred between Chain 1 and Chain 2 remain constant at all times.

What are the two types of cross-chain bridges?

Trust-based bridges and trustless bridges are the two classifications of cross-chain bridges.

Trust-based bridges

Trust-based bridges run based on the trust users have in the “federation” or “custodial bridges.” Centralized by nature, this requires a federation of people or mediators to operate.

Although trust-based bridges are quick and cost-effective for transferring large amounts of cryptocurrency, they are incentivized to keep the transactions running and not to particularly focus on safety or preventing fraud.

Trustless bridges.

Trustless bridges, on the other hand, run completely on smart contracts, making them decentralized by nature. These run like real blockchains with individual networks contributing to translation validation and also provide better security compared to the former during translations.

With that said, smart contracts are still not robust, leading to exploits, discussed later in the article.

What are the best cross-chain bridges currently?

Among many other popular cross-chain bridges, these are the best in 2022.

Polkadot (DOT): On Polkadot, dApp, and blockchain, developers can build customized chains called Parachains. Here, the relay chain provides security and allows the safe transfer of assets between Parachains on the Polkadot network.

Polygon (MATIC): The Polygon cross-chain bridge connects the Polygon sidechain with the Ethereum mainnet to support the transfer of crypto tokens and NFTs. This cross-chain bridge also offers low gas fees and enhanced security.

Avalanche (AVAX): This cross-chain bridge allows the transfer of tokens between AVAX & Ethereum. AVAX is one of the earliest innovators of cross-chain bridges and among the quickest smart contract platforms.

Some other popular cross-chain bridges are Binance Bridge, Ren Bridge, and Connext.

What are the risks associated with cross-chain bridges?

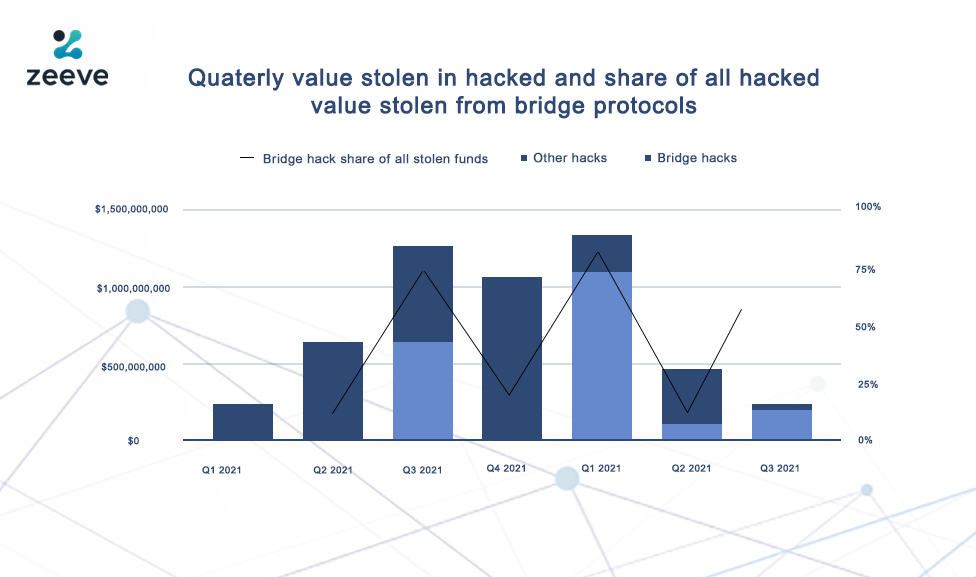

According to Chainalysis, around $2 billion in cryptocurrency has been stolen from exploits & hacks across 13 separate cross-chain bridge hacking incidents. Out of the total funds stolen in 2022, 69% were from the attacks on cross-chain bridges, and the below chart paints a grim picture of the same.

Here are some of the current risk factors plaguing cross-chain bridges.

Smart contract exploits

As evolved as smart contracts are, some of the biggest hacks in recent history occurred due to smart contracts exploits. This includes the $320 million Wormhole attack and the $600 million Poly Network exploit.

User fund thefts

Custodians can always go rogue in the trusted bridges format, stealing user funds. To mitigate this, custodians are often forced to provide a bond that can be slashed in the event of sketchy behavior.

Liveness problems

Custodians or validators may slack off or neglect their duties of validating cross-chain bridges, resulting in safety compromises and delays.

The silver lining

At the end of the day, these security issues need not deter you from adopting cross-chain bridged as smart contracts are getting smarter and cross-chain bridged are getting stronger and robust by the day. In the Wormhole attack mentioned above, the entire amount of $320 million was recovered, and Binance was up and running after a $100 million cross-chain bridge hack.

This goes to show that major companies are learning from their errors, and preparing better to avoid orchestrated attacks. Needless to say, cross-chain bridges will soon not be the weak link to further blockchain technology.

At Zeeve, security, constant monitoring for downtime, priority response on incidences, and alerts are our top priority. Zeeve supports enterprise-grade deployment and management of Blockchain networks and nodes on the leading Blockchain protocols like Ethereum, Polygon, Avalanche, R3 Corda, Corda OS, Hyperledger Fabric, Sawtooth, and Fluree.

Wrapping up

Despite the looming threats of hacks and exploits, there is much work yet to be done to make smart contracts more robust, build better cross-chain bridges that interact among various blockchains, and make cross-chain bridges completely trustless, gradually.

It is evident that interoperability is the future of blockchain, and the industry is certainly moving in the right direction.

Work with Zeeve

The future applications for large-scale interoperability depend on the regulatory frameworks. Zeeve will help your organization implement a blockchain-based system.

We are the leading blockchain infrastructure management platform. We help enterprises and Blockchain startups to build, deploy and manage their decentralized applications (dApps).

We feature robust APIs to build DApps for many use cases across industries. Let’s connect to understand more about blockchain interoperability. Feel free to contact us on Twitter and Telegram.