Not long ago, a report from the WEF took the Internet by storm, claiming that 10% of the GDP shall be moving to blockchains. At one end of the spectrum, it was fascinating to see an emerging technology dominate. Still, an epiphany that hit right in the face nonetheless made one wonder that blockchains are public, and they have an innate scalability issue.

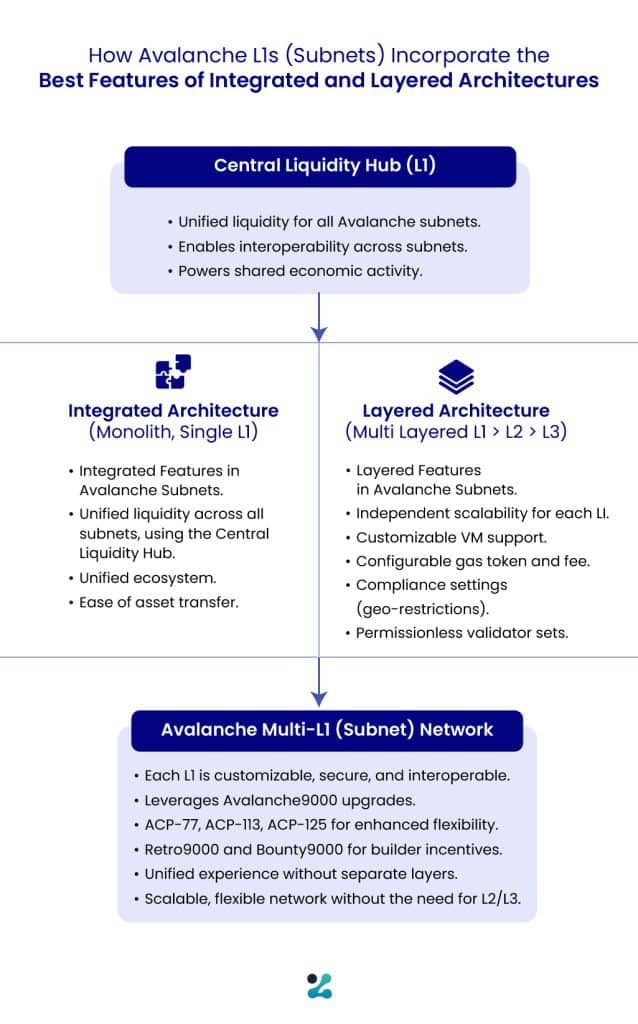

With that being said, to move 10% of the world’s GDP to blockchains, flexibility, interoperability, privacy, speed, and security(FIPSS) should all occur in tandem. However, the present blockchains are too monolithic to operate on top of them to experience the above. For context, if you are building on a monolithic blockchain, you will be pinned by its consensus rules.

However, if you go down a little to their scaling layers like L2, you are pinned by a lack of interoperability sometimes. Now, if institutions ever have to adopt blockchain to build their use case, they need all FIPSS tied together. It sounds like a distant dream, but Avalanche, through two of its major breakthroughs, Avalanche Consensus and Avalanche L1 Subnets, is making this possible. As a result, Avalanche is the go-to layer for launching finance, insurance, payments, vehicles, entertainment, culture, and many more use cases. Let’s find out why Avalanche L1 custom chain launch is on every institution’s lips.

What Makes Avalanche Subnet The Apple of Eye for Institutions?

When you are an institution seeking a blockchain platform for operations, you would be looking for speed and finality, not only speed. That’s where Avalanche L1 custom chain launch options break most of the ice compared to their counterparts. Why? Because the Avalanche ecosystem does not measure the network efficiency in speed, on the contrary, speed should be equally aligned with finality. For example, suppose a blockchain has 100,000 TPS, but it is handled by a handful of validators to achieve that speed. It could compromise the whole ecosystem. We have already seen a brief snap of the same in the Solana ecosystem.

Now, Avalanche abstracts the same by introducing a new concept: Time to finality. Due to this, suppose you are an institution launching Financial Markets and High-Frequency Trading. In this case, you don’t only settle for a high speed but instant finality. Avalanche has such super high finality that before your trading platform browser refreshes to fetch you the current balance, the blocks will be validated on the Avalanche L1, aka Subnets. Courtesy of the method of sub-sampling of validators used in the Avalanche ecosystem that completely wipes away the erstwhile problems that institutions have experienced while using traditional L1 monolithic blockchains, where VM restrictions put gas fees to go off the roof and even disallow institution-grade ecosystem adoption as per their requirement. Thereby making institutions hop onto the Avalanche L1 custom chain launch as and when required.

Who Are Institutions Using the Avalanche L1 To Launch Their Use Cases?

- Deloitte

It is known that the majority of the fundraisers and non-profit organizations’ funds are mired in controversies due to scams. To put an end to this, Deloitte has launched the “Close As You Go” program. The “Close As You Go (CAYGs)” program adheres to the FEMA/ US Federal Emergency Management Agency guidelines. For that matter, using Avalanche L1 custom chain launch, aka Subnet launch has played a key role. For example, under the “Close As You Go” scheme, all the concerned parties, like the state and local governments, have to submit specific forms for reimbursements to avail of the benefits.

However, without a truly verified and transparent system, these contributors are exploiting the technology loopholes to claim dubious benefits. By using the Avalanche L1 custom chain launch approach, institutions like Deloitte can track down all the valid details, like critical documents that can be quickly gathered, processed, and authenticated.

Due to this, the CAYGs could process millions of claims quickly and during the need of the hour and eliminate all unnecessary and false claims. Hence, eliminating all the instances of fraud.

In addition to this, the immutable, fraud-proof nature of the blockchain allows the record-keeping to be water-tight and verifiable at any given point in time. And it is also possible to automate the process as well through the use of the Avalanche L1s (subnets) to expedite the disbursement process. In this way, Avalanche has been helping Deloitte in a very big way.

Why Did Deloitte Choose Avalanche L1 Subnets and Not Any Other Blockchain?

- Deloitte has always been eyeing at meeting super high speed with a lightning-fast finality.

- Along with this, they were also looking for a blockchain that could guarantee these without disrupting the environment. In all these aspects, the Avalanche L1 custom chain launch for institutions has left no stone unturned and guaranteed everything from the ground up.

- Lemonade

In an economy, if there’s only a 3% insured population, it is implied that access is narrowed because of cost. Why? Because there are a lot of intermediaries involved in making operations efficient and profitable. However, in doing so, they are amplifying the cost.

But, if you want to cut down on the cost to make this system work, you need to eliminate the intermediaries without jeopardizing efficiency. That’s where Avalanche L1 custom chain launches, aka Subnets, have played a key role for Lemonade.

Through the subnets, important information like insurance claims and processing, which were erstwhile done through brokers, can be all replaced with smart contacts. Oracles provide necessary real-time weather data for processing the claims. In this way, using oracles and smart contracts has significantly reduced the insurance cost so low that now they are available for even $10 with a fast processing window. Hence, so far, more than 300 million farmers who have faced real climate risks to their farms and livestock could not just access insurance for the first time but also get all its benefits.

Roy Confino, head of strategy and operations at Lemonade, says,” Through the use of Avalanche L1, we use what’s called the area yield index. We take a segment of land and say 1,000 farms are on the land. We sample five. If those farms usually grow 3 tons of maize per hectare but grow less than 2 tons, we pay all the farms.” In this way, not only is it making a difference, but also uplifting the lives of the farmers.

Why Did Lemonade Choose Avalanche L1 Subnets and Not Any Other Blockchain?

- Like Deloitte, Lemonade also has environmental concerns, which have compelled them to choose Avalanche L1 custom chain launch over other blockchains because one of the primary developers of Avalanche, Ava Labs, has been purchasing carbon credits to offset its carbon footprints.

- Along with this, while processing the insurance, it was necessary to keep the fees low so that all the farmers could easily achieve the benefits of the insurance. In this regard, Avalanche subnets have played a key role in keeping the fees low due to their consensus mechanisms.

- Littio

An economy on the brink of a collapse due to its monetary devaluation could trigger a catastrophic economic cascade of events if left unchecked. To put an end to it, Litto, a Colombian NEOBank, is opening global exposure of the USD to its public to tame the rising inflation. However, the task is easier said than done when you do not have a transparency mechanism to check the backing of the native currency. To overcome this challenge, the Litto Network uses the Avalanche L1s, aka Subnets, to provide yield-bearing saving pots.

It will be directly linked to the US-dollar/Treasury bills, deriving the value from the same. In this way, through the Littio banking App, more than tens of thousands of the Latam population who have been subjected to monetary exploits and deprived of using dollar-backed savings accounts could do so through the Litto App.

Littio is using the Avalanche Subnets so that users can easily transfer their Pesos into USDC and, after that, either save the same for future use or even spend the same through the Littio debit card. It is expected that the market will flood to a new high after seeing increasing crypto adoption in Latin America, which stands at $562 billion or 9% of the total global crypto adoption. If such a technological masterpiece makes a breakthrough, it could further push adoption to new heights. Since more than 70% of the LatAm population is unbanked due to very high minimum balance requirements.

However, Littio, through the use of Avalanche L1 custom chain launch, is making transactions super effective, with low cost and high yield-bearing. In the last 4 months, the Yield Pots have generated $250K in user returns by processing $80M in transactions. This could multiply by manifolds in the coming months when this population is able to get exposure to the increasing Treasury bills yield that they can convert to pesos and purchase with very little transaction fees because of the L1 subnets.

“Littio and OpenTrade exemplify how Avalanche’s technology can enable underbanked populations to access compelling products and services that are otherwise unavailable or untenable via traditional rails leverage,” said Morgan Krupetsky, Head of Institutions & Capital Markets at Ava Labs. “I’m thrilled to see OpenTrade’s RWA-backed yield products and ultimately real-world businesses being built on the Avalanche platform.”

Why Did Littio Choose Avalanche L1 Subnets and Not Any Other Blockchain?

- Low-cost transactions were the key because Litto was looking forward to making the app/debit card mainstream and easily acceptable. However, to do that, it should provide an infrastructure that can even process microtransactions at a fraction of the cost. Compared to other L2, Avalanche L1 custom chain launches, aka subnets, have not just been scalable but have also been very low on fees, even at the base L1 layer, which is simply outstanding. Hence, Litto wanted to choose Avalanche over other blockchains because it was not only fast but also very cheap.

- Consistency was another reason driving Littio towards Avalanche L1 custom chain launch, aka Subnets, because in comparison to other blockchains, on Avalanche C-Chain, the finality was 2 seconds, which is essential if you are building a whole sector on top of an ecosystem.

As you can see through all these examples, Avalanche L1s, aka Subnets, have undoubtedly redeemed themselves as the best L1 for institutions for a variety of reasons. So, if you are an institution looking forward to launching your own application-specific blockchain/custom chain, in that case, Avalanche L1 custom chain launch could be your go-to, and service providers like Zeeve can help you set up your own custom Avalanche L1 chain.

Launch Your Avalanche L1, aka Subnet With Zeeve

Zeeve simplifies the development of Avalanche L1s (Formerly known as Subnets) with a wide range of tools and the Zeeve platform itself. From rapid node & network setup to RPC configurations to validator node settings, Zeeve ensures that your Avalanche L1 custom chain launch is achieved in minimal possible time and without any heavy lifting of infra.

Additionally, Zeeve offers a powerful Avalanche L1 management dashboard that provides you with detailed insights and a real-time view into all your active L1s and their vital aspects, such as node performance, validators, account & access control configuration, as well as system-level monitoring.

Besides Zeeve-managed services, there’s a strategic partnership with Benqi for liquid staking and lending, followed by 30+ third-party integrations that can be relevant for Avalanche L1 custom chain launch

with all sorts of integrations. The cherry on top is you can view and manage your network from your Android and iOS devices on the go. For more information about Zeeve’s Avalanche L1 custom chain launch services, contact us. Email us your queries or schedule a one-to-one call for an Avalanche L1 demo.