The Ethereum community recently approved ERC3643 as the first tokenization standard. It was proposed in 2021 and originally developed by Tokeny and later open-sourced.

It has a huge potential considering the growth of RWA sectors as projected by renowned institutions like BCG. From $0.6 trillion in 2023 to 16 trillion by 2030 is estimated to be the business opportunity for tokenizing global illiquid assets.

ERC3643 is huge because it introduces a tokenized standard for compliant RWAs within the public blockchains.

In this article, we will dive deep into what ERC3643 is, how it works, why we even need it, and how that will impact the global RWA market.

What is ERC-3643? Why do we need another token standard?

ERC-3643 is a token standard for securities that streamlines their transfer following all the regulatory guidelines. In this way, it ends up as a perfect tool for making RWAs inclusive on the blockchain, which can be easily validated and transferred on-chain following the ERC-3643 standards.

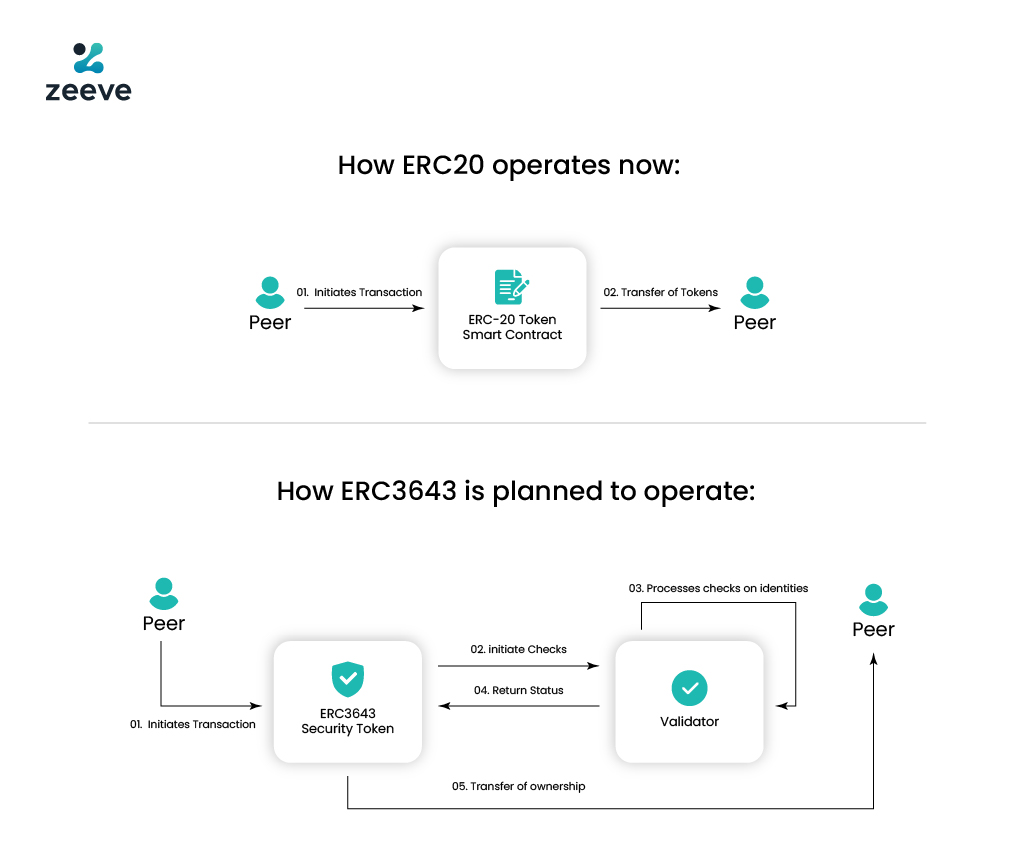

The reason ERC-3643 is required is that, at the moment, the existing token standards, which are ERC 20 and ERC 721, cannot perform on-chain compliance, ownership guarantee, and auditable registry. These specifications are hard-coded into ERC-3643, which makes on-chain identity verifiable, allowing easy exchange of RWAs because all the compliances and regulations that previous standards failed to fulfill have been achieved by ERC 3643. As a result, through ERC 3643, it is possible to trade in RWAs. As businesses who are looking forward to dealing in RWAs in regions like the European Union, where the MiCA bill is clamping down on VASPs, ERC-3643 will undoubtedly provide them with a safe refuge to deal in RWAs.

.

How does ERC3643 Token Standard Work?

ERC-3643 works by establishing a programmable agreement for assets using the Ethereum blockchain to mint, manage, and trade RWA tokens. Since ERC-3643 uses Ethereum smart contracts, it contains all the vital information required to prove the ownership of the assets, like owner’s information, legal conditions, and compliance guidelines through an on-chain ID, identity registry, identity registry storage, trusted issuer registry, claim topics registry powered by a permission token interface. Now, what does it result in? You will first have to understand the previous scenario when ERC-3643 wasn’t there. In the erstwhile set-up, there was no infrastructure in the form of a verifiable On-chain ID present, which can truly represent ownership of the asset. As a result, when parties wanted to deal with each other, it was very hard to validate the ownership. ERC3643 creates a hashed/anonymous credential that acts as proof to verify the ownership and trigger an exchange between parties.

So, if you take an example where there are three people, Alice, Bob, and Cindy, and if Alice and Bob have completed all the legal documentation like KYC and others required to invest in an RWA while Cindy hasn’t completed the KYC and others but she possesses a wallet. In such a case, the ERC3643 standards would match the transaction of Alice and Bob and help trigger the exchange because these two parties have adhered to all the rules that the ERC3643 on-chain contract has proposed to trigger the exchange.

Through such an efficacy, the ERC3643 standards have made the following easily possible;

- Asset Representation: A real-world asset can be easily represented on the blockchain and made available for trade.

- Legal and Regulatory issues: Real-world assets have specific compliances to meet. Without jurisdictional clarity on blockchain, making their representation legit is debatable. ERC 3643 has helped achieve the same by including a legal mechanism as per jurisdiction to govern the tokenization of assets.

- Standardization: RWAs have been missing the standardization, which obstructed their entry into the blockchain space. ERC3643 standards have introduced standardization, which has simplified interoperability across various DeFi protocols

The benefits of ERC3643 for the RWA sector

Fractionalized Ownership: ERC-3643 allows the creation of digital tokens that can represent an asset. For example, real-estate properties that are worth more than $300T and excessively inaccessible can be made accessible by splitting the same into separate standalone tokens representing ownership of their own. In this way, it can help execute the trade of real-world a in a fully secure, transparent, and verifiable manner.

Interoperability: Though RWAs were introduced much earlier than ERC-3643, the absence of standardization obstructed interoperability across protocols. So, even if enterprises or businesses wanted to launch their RWA projects, they faced an imminent challenge of liquidity risks since different protocols couldn’t communicate with their applications. With the help of ERC-3643, standardization has been established, restoring communication with different protocols.

Upgradability: Through ERC-3643, it will be easy to upgrade a token without having to migrate to a new smart contract. To put that into perspective, for example, if you have an application that allows the exchange of ERC-20 tokens. Now, if you want to include another feature for the Dapp where, it can also support additional features like compliance checks, identity management, and the ability to represent a portion of an asset. And the key trade-off is that you can do all of that without making any further changes to the smart contract. Hence, it simply aids faster migration and quick deployability.

Some Examples of RWAs where ERC3643 can be beneficial

Introduction of Tokenized Treasury Bills (T-T-B)

Traditional T-Bills undoubtedly delivered unprecedented returns for investors this year. Nonetheless, something that kept investors on the edge of their seats was tokenized T-bills. In the last eleven months, starting from January to November, Tokenized T-Bills have occupied a market cap of $700 million, growing at a 600% Y-o-Y. These bills have generated way over 5.2% YTM or Yield To Maturity, which has dwarfed its immediate peer, the traditional US Treasury Bill, which has yielded only 3.5% in the last 5 years.

Now, the question is why Tokenized T-Bills are becoming an investment haven lately. Credit goes to ERC-3643 standards, which have made transferability and interoperability which the investors were not getting while using traditional T-bills. As a result, they are flooding the investment ecosystem. The present performance of the Tokenized -T-Bills is expected to create an optimistic target of $4 T by 2030 after the introduction of ERC-3643 standards. Out of that, T-Bonds or Tokenized Bonds will have a $1 T share. Franklin Templeton’s Franklin OnChain U.S. Government Money Fund (FOBXX)Benji Token has already capitalized on the Tokenized -T-Bills sentiment by growing to $276 M at the time of writing.

These developments have undoubtedly anchored the narrative that Tokenized T Bills will be the next big thing to watch out for, and key names like JP Morgan and BOA are the players that will trigger the momentum ahead. ERC-3643 standards have evoked a new identity for T-bills where they do not just turn easily accessible but interoperable and transferable at the same time to enjoy maximum trade off.

Tokenized Private Credit

Though DeFi undoubtedly simplified the way to access loans through its flash loans and crypto to crypto collateralization, it did expose points of complexities nonetheless for the masses. For example, not everyone is well versed in handling the flash loan swapping across protocols. Along with that, even crypto-to-crypto collateralization for loans was too complex from the standpoint of ease of loaning.

Onchain Private Credit enjoys an upper hand in this regard because they mix off-chain assets and business income as collaterals, significantly improving the capital efficiency of loans and making loans accessible to the untapped population. These trade-offs are exclusively powered by ERC-3643, making RWAs accessible within the decentralized ecosystem for much-improved inclusion as collateral to access loans. Bru Finance, a commodity tokenization platform with more than $650 M in commodities, has extended its credit line to the tune of $150M to farmers, and they are doing that through an off-chain yield mechanism which is built atop ERC-3643 that triggers progress of the farmers and extend loans to them based on such data. Even CiTi Bank is working on the Citi Token Service project along with Maersk and a Canal authority to act as guarantors for providing loans and credit finance to small businesses by bringing their immovable assets as collaterals through ERC 3643 standards.

CBDCs Bridging the TradFi and DeFi Gap

The crypto market has already experienced its share of bitterness regarding using stablecoins backed with assets with no intrinsic value. The ghosts of the past in the form of Terra USD still haunt many investors. Through CBDCs, we can see the gaps between TradFi and DeFi narrowing down. DeFi protocols are already planning to integrate with the CBDC pilots, and ERC 3643 can facilitate that initiative through the easy introduction of RWA to back those CBDCs within the DeFi ecosystem.

These CBDCs can easily move between DeFi protocols and reduce the exposure of the crypto assets within the DeFi space. Right now, projects like Mariana are already flagging their POCs in conjunction with the Bank of France, the Swiss National Bank, and the Monetary Authority of Singapore. Other future projects like Project Guardian will further bolster the narrative of bringing $16 Trillion of global illiquid assets to back CBDCs by 2030 using the ERC-3643 standards to bring RWAs to DeFi and crypto.

Tokenization of Real Estate assets

Real estate is the most undermined asset class, which has been specifically meant for the well-offs. However, that equation has been slowly and steadily changing through the tokenization that ERC-3643 standards have triggered. Now, it is possible for investors to split premium properties and sell them off as tokens to raise capital without getting stuck between jurisdictional regulations and enjoying the benefits of a public blockchain. On top of this, real-estate tokenization also enables quicker financing of real-estate assets because they can be easily liquidated at the time of foreclosure easily and conveniently to raise capital.

Tokenize RWAs with the benefit of ERC3643 using the Zeeve platform

To tokenize any Real-world asset (RWA) using blockchain, you need a solid infrastructure, and that’s where Zeeve comes into play. Whether you’re launching on one of the 40+ available public blockchains like Ethereum or Polygon, using our Rollup as a Service (RaaS) for your custom Optimistic or Zero-Knowledge rollups, or creating a standalone blockchain using Cosmos SDK or Substrate, Zeeve offers all the essential tools for on-chain asset integration. Plus, we provide a one-click sandbox for effortless testing of your rollup configurations. As an ISO, SOC Type II, and GDPR-compliant platform, we ensure compliance with the most stringent regulations in finance and real estate.

Got questions about ERC3643 and how it can be leveraged in your project? Reach out to us. Our experts can guide you on going LIVE in the most cost-effective way with the least turnaround time. Schedule a call today and let Zeeve simplify your tokenization experience.