Currently, the token economy is flourishing, and many industries benefit from it. One of the buzzwords related to the economy is asset tokenization which means tokenizing real-world commodities.

Investing in real word assets such as — company shares, paintings, real estate, and many more are promising. However, one of the significant problems is the lack of liquidity. There is a long transaction process for real-world asset investment. Tokenization in real-world assets guarantees many advantages and promotes the democratization of investment.

Buyers execute transactions immutably by trading tokenized assets, and the investor receives crypto. One can see the market’s growth in the upcoming years, with a $3,894 billion digital real estate ownership industry by 2029.

In this article, we will understand tokenization of real-world assets and how to tokenize a real-world asset. In terms of real-world assets, we will consider real-estate asset tokenization and will look over its advantages and challenges in tokenizing real-world assets.

An Introduction to Real-World Asset Tokenization

Tokenization is significant for — eliminating mediators, better liquidity in the market, and faster transactions. Tokenization is the process of converting the ownership of a real-world asset such as land, gold, property rights, etc., into a digital token. The tokens act as a transferable unit and represent real-world assets. Anything having a monetary value in the real world can be tokenized and traded on the blockchain network. The tokens that we require for trade are issued by the security token offerings.

Companies are adopting the tokenization of company securities, land, and industrial assets. The transactional drawbacks are the bare minimum, and the tokenization improves — security, promotes crowdfunding, and gives better returns. The tokenization also allows those real-world assets which couldn’t become a part of the DeFi ecosystem.

What is Real Estate Asset Tokenization

Real estate asset tokenization divides an asset into digital tokens. One property is divided into different parts, known as assets, and those assets are monetized. The various terms and conditions are maintained on the smart contracts. The events are also mentioned in the contract. As the event gets completed, the algorithm of the contract becomes activated, and the block keeps getting added to the blockchain.

Similar to traditional real estate, the price also fluctuates with the usage of blockchain technology, but still, there is more security, frictionless payments, and information stored on the blockchain. Also, not any one organization or central authority controls the real estate database, unlike the traditional ecosystem.

In the recent I.D.E.A.S. summit, Blockchain officer Geoff Thompson explained more on how real estate tokenization goes beyond fractionalization and helps in security and leaving no uncertainties regarding the closing of a deal.

By participating in tokenized trade, you receive fractional ownership of the land. This also indicates an increase in market participation. The reverse can also be done when a small part of the land can be tokenized to get money, thus using the land as collateral. The three types of real estate tokenization are:

- The tokenization of the residential area can be done in the form of fractions. The fractions are then sold to developers, institutions, and real estate investors.

- Employing the legal-complaints to tokenize commercial properties is commercial tokenization.

- Trophy tokenization refers to the tokenizing of the real estate assets in iconic buildings that are present at profitable locations.

How the Real Asset Tokenization Works

The work mainly depends on the smart contract functionality. Smart contracts turn real assets into digital assets. The conditions are coded on the contract and are shared with the blockchain network. And as we know, smart contracts are self-executing once the contract terms and conditions are met, the deliverables, i.e tokens, are allotted.

Tokenized real estate investing employs a special-purpose vehicle for investing in real estate. Furthermore, a private placement offering is created to maintain details of the investment.

4 Steps in Real Estate Tokenization Implementation

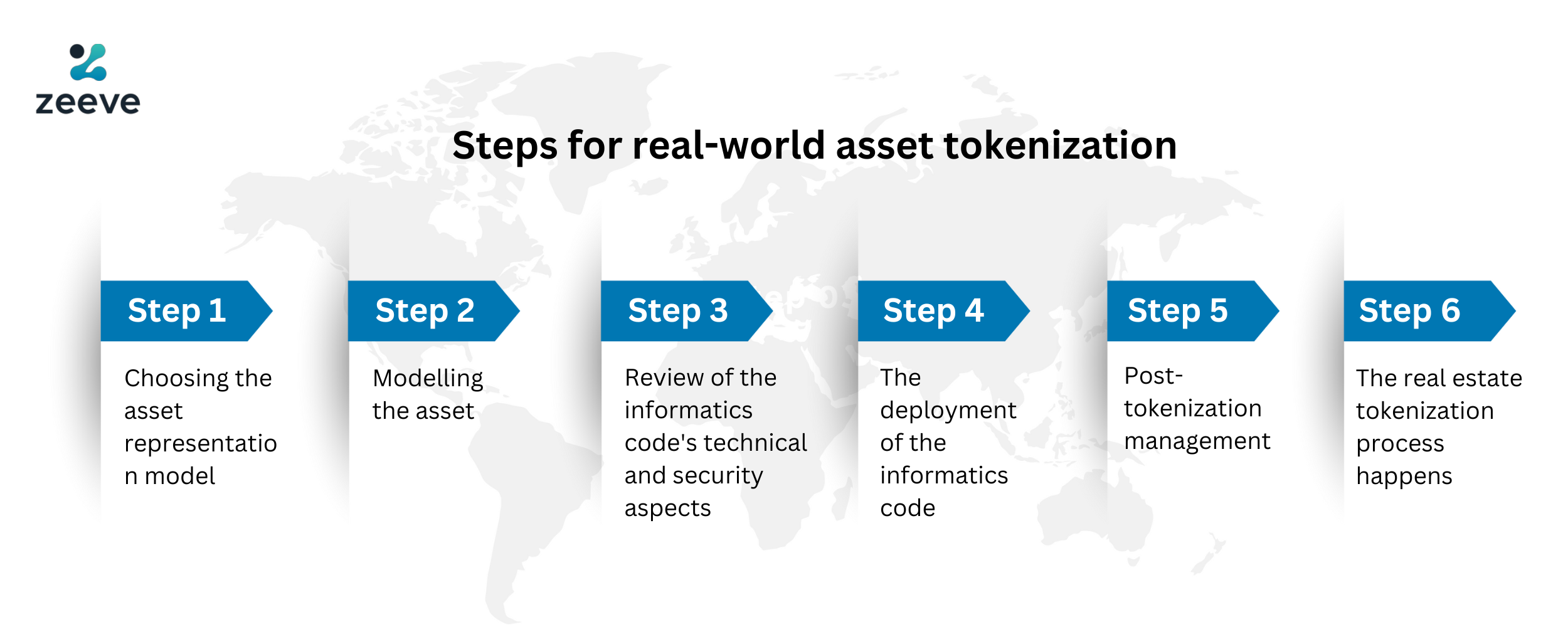

Before venturing into real estate tokenization, it would be great for you to understand the step required on “how to tokenize real estate assets.”

Step 1: Deal Structuring

The first step is to understand more about the jurisdiction involved, the type of asset, and the shareholder type. The asset owners decide what property to invest in, and the issuers decide on shareholder type. Both parties also decide what terms and conditions they would like to include. They are certain factors to consider, such as the time period for ROI, legal formations, and cash on return.

Step 2: Legal Structure

In legal structuring, digitization is being done. The data present on the document is uploaded to the blockchain network. The information is encoded on the network and on smart contracts. Further, security tokens are provided. The structure mainly followed for the real estate tokenization is as follows:

- Single Asset Special Purpose Vehicle (SPV) – The structure is mainly followed by institutional buyers.

- Real Estate Investment Trust – REIT is beneficial for retailers. Although expensive to operate but are beneficial to form a digitized share.

- Real Estate Fund – It is a private equity fund, and the tokens represent the units here.

- Project Finance – Retail investors are invested in projects, and tokenization works best to raise funds for them.

Step 3: Technology

Choosing the right technology is crucial to execute real estate tokenization. The initial step is to select a blockchain network and a token. A marketplace is decided to offer the tokens, raise capital, and improve liquidity. Other than that, a custody solution is required to save the tokens and to get real-time updates on the KYC. KYC verification is important to provide digital security to investors.

Step 4: Distribution and Marketing

In the marketing and distribution of real estate assets, the emphasis is on which payment methods are accepted and information related to digital wallet usage. Firstly, in the primary distribution, the tokens are distributed to the investors. Then, the post-tokenization involves voting and dividend distribution. Finally, there is secondary trading, in which the focus is on the real estate token trade on an exchange platform.

Benefits of Real Estate Tokenization

Tokenizing real-world assets benefits both investors and asset owners. For the asset owners, there is instant liquidity and tokens that are compatible with exchanges. With the investors, it helps provide rapid settlement and cost-effective trading. A few more benefits of tokenization of real-world assets are:

- The transactions are transparent, as the decentralized nature of the blockchain provides. There aren’t closing costs, and therefore the transaction cost is reduced.

- The liquidity in the network is improved as the fractions of real estate are sold rapidly.

- Small-scale investors can buy the real estate of their choice. The accessibility to real estate has enhanced.

- There isn’t any counterparty to which gets involved in between. Thus the trade becomes streamlined and secure.

- Finding quality real estate investments becomes easy as well. The marketplace is vast in traditional investment. However, in the digital world, reaching prospective buyers becomes effortless.

Disadvantages and Challenges Ahead

Every technology has its own set of challenges which are resolved with time, and tokenization of real-world assets also has a few limitations, as mentioned below:

- The blockchain network is secure but hackers sometimes try to mess with the smart contracts. As often, there are loopholes in the smart contracts that become a breeding ground for hackers.

- Licensing is still a challenge in real estate tokenization. The licensed platforms manage the security token offerings. Obtaining a license is a cumbersome process, and there are multiple phases involved.

- The tax regulations are again difficult to understand in the blockchain and crypto as the tax regimes are not well defined. There isn’t a unified tax system.

Wrapping Up

In a nutshell, real estate will now be accessible to small investors thanks to blockchain and tokenization. The prices will become affordable. However, there will be challenges for the traditional players. In the future, the demand will increase, and the precise adoption of the technology will be fruitful. One more influence here will be the emergence of cross-border trade in real estate.

The dealing between the parties will be secure and fast as the regulation will improve in the upcoming years. Those who are ready to understand the technology and get equipped with it will witness growth.

Collab with Zeeve

We are the leading blockchain infrastructure management platform. We help enterprises and Blockchain startups to build, deploy and manage their decentralized applications(dApps). We are also helping businesses in real estate asset tokenization. We feature a robust set of APIs to build DApps for a plethora of use cases across industries. Let’s connect to understand more about the usage of blockchain and the tokenization of real estate assets. Feel free to contact us on Twitter and Telegram.