As countries around the globe work towards introducing their own cashless alternatives, many people are assuming that the use of cash will die down very soon. It is true that the last few years saw more and more use of mobile wallets and digital payments leading many people to believe that the death of cash is inevitable. The financial world has undergone a sea of change over the last decade or so more so with the demonetization, Covid, digital payment systems and also popularity of the cryptocurrencies and blockchain technology driving these changes. Financial entities across the globe are also leveraging the technological innovations and advancements to enhance the efficiency and effectiveness of the financial systems. Central Bank Digital Currency (CBDC) is a complex topic which has been generating buzz among central banks around the world.

The Bank for International Settlements reports that 85% of global central banks are either studying or piloting CBDs. So what do they entail? What is behind the big hype and what are the key points one can take away from it? We take an expert look at this emerging technology in our below blog guide.

As the CBDC market is still developing, here’s a look at some of the notable features it has and how it’s worth keeping track of. The market’s fundamental footprint in the crypto sphere is constantly expanding.

CBDC: Digital Money Being Developed By Countries

CBDC are being developed by a number of countries as a way to replace cash. Analysts, central banks and consultants from various banks are looking into its economic, technical, and political feasibility, and financial policy. China launched their CBDC in January this year and Bahamas followed suit a few months later – along with other countries like Bahamas also joining them soon after! CBDCs are also underway in many countries such as France, South Korea, and Thailand. With India planning on releasing its own version by March 2023 it seems like nothing can stop these new financial systems – CBDCs from taking hold anywhere else anytime soon. UK, US, Netherlands, Italy, Japan, Canada and Brazil are exploring possibilities of developing new types of CBDCs.

But what are these CBDCs and why are central bankers investigating the feasibility of the development of these CBDCs? Let’s try and get some questions answered on the new digital currencies to understand how they are a game changer for the financial ecosystem and what they can mean for banking as well as non-banking firms. In this article, we’ll discuss various aspects of this topic, including financial significance, modeling techniques, and properties, and what CBDCs could bring about if information sharing on a distributed ledger were to occur.

So, what is actually CBDC?

CBDC is a digital currency, comparable to a cryptocurrency in the digital world, which constitutes a domestic currency issued by the Central Bank of a country. However, this virtual currency is not to be mistaken for digital money that is stored within you. It’s different from digital in any context because there’s an electronic currency supplied by the central bankers, while digital wallets, online banking, and v-cards are used for transferring money electronically.

Evolution of Digital Money to tokenized money and CBDCs

Experts argue that we are on the verge of electronic money 2.0. Not the old electronic money that has been around for several decades, but a type of digital currency based on tokens. The blockchain technology used to create cryptocurrencies, stablecoins, and many proposed central bank digital currencies is the foundation of tokenization.

Bitcoin, which emerged as the first cryptocurrency on that basis in 2008, shows how the technology can be put to use. Blockchain, a technology that allows the exchange of data without any central authority, facilitated the new wave of tokenized finance in the following years.

Facebook’s announcement of Libra (now named Diem) in 2019 made for a different inflection point. Several new stablecoins emerged after the introduction of Libra as a private stable coin – a currency that was pegged to a stable asset (e.g. fiat money, physical gold etc).

With the rise of CBDCs, central banks the world over have initiated interest in digital currencies. The initial cash redemption deal and digital representation of fiat currency are the most important features of CBDCs. This makes CBDCs different from cryptocurrency and stablecoin forms such as utility tokens.

Tokenized & value-based approach to banking

Commercial central bank digital currency (CBDC) represents a possible future turning point in the operations of financial administration. The significant novelty is the application of a tokenized, or value-based, approach to the practice of banking. CBDC tokens are much similar to those of a bearer token, such as a bank note which has all the key characteristics required to allocate true value, real ownership, and also assign transfer of ownership.

CBDCs is a key development in the financial space as it can offer more diversified formats of bank money, thereby having profound economic and financial implications. Besides significantly affecting the existing banking practices locally, CBDCs also aims to introduce a novel, global financial system that meets the changing user needs on a worldwide scale. Rather than refining the existing payment methods, CBDC’s innovation is based on the introduction of tokens that can be used as tools of utility, and reach and transaction. This innovation further complements the payment methods and serves as a core component in driving the transformation of general finance.

Blockchain: best suited technology for CBDC

The direct liability of the central bank will be realized through the CBDC. The CBDC will be using distributed ledger technology that only the Federal Reserve and its designated parties may have access to. Blockchain technology is the most effective technology for handling the functions of innovative monetary systems of the CBDC such as the issuance of tokens, the execution of deals, and the purchase and sale or swapping of assets. It is for blockchain technology that the central bank serves as a “smart” mechanism, while it will also be helping in tightening the security and bringing about the much-needed prudential controls.

Types of CBDCs

One way of classifying CBDC marketplaces is relative to their value calculation approach. CBDCs can be either wholesale or retail. Under the wholesale model, it is obligatory to grant a few banks and financial institutions access to the central bank digital currencies. In the retail market, access is open to many more to even the general public, including the corporates and businesses or to all consumers across the economy.

On the other hand, retail CBDCs are not as prevalent because market development in industrialized nations has more established interbank systems and capital markets. In contrast, retail CBDC growth is more prevalent in emerging markets with expanded financial sectors.

Alternatively, alternate ways to categorize CBDCs are to determine whether or not their underlying format is account-based or token-based. In some account-based CBDCs, ownership of the CBDC is tied to an identifier, preventing prospective buyers from using the seller’s index to track balances.

Wholesale Retail 3 Direct, indirect and hybrid models

Another category of CBDCs is based on their distribution networks.

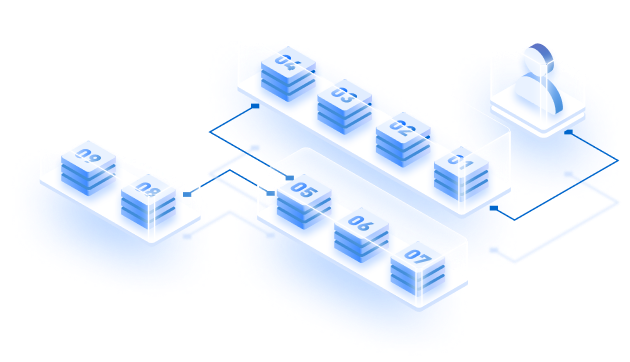

Direct Model – Under the Direct Model, everyone involved in a transaction maintains an account with the central bank. Payments between accounts are automatically transferred, and all transactions will be guaranteed through the central bank. The central bank issues the official currency, and will issue any applicable authorization. It is the central bank that takes care of the regulatory requirements such as Know Your Customer (KYC) and anti-money laundering (AML).

In a smart contract-based format, CBDC ownership is tied to a digital signature. Cryptography can be used to confirm the sender of crypto-assets and their authenticity. This means you can transfer between accounts or share tokens without revealing your electronic signature. In this way, the tokenized format simulates ownership of cash. Hence central authorities can program tokenized CBDCs besides the other forms of tokenized money such as digital currencies and stablecoins. Those CBDCs function as programmable money wherein different logics are wired into the definition of money on its own, whereby rules for payments between multiple participants can be automated. Such CBDC is also known as synthetic CB.

A large percentage of central banks are utilizing the hybrid model, under which the central bank posts CBDC to an accredited intermediary such as a commercial bank or a fintech. As this intermediary completes the procedure, however, the asset remains in the central bank.

What are some of the perceived benefits?

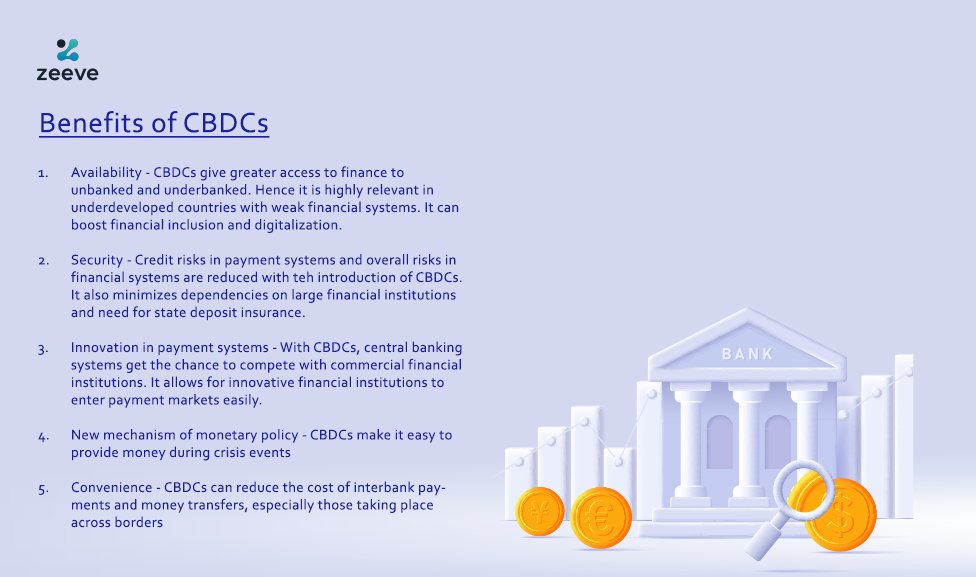

CBDCs are enjoying increasing popularity because they are thought to be a beneficial alternative. For example, governments are looking at CBDCs for a reduction in administrative costs. Moreover, there are plans to make the central banking organized, which could level the playing field between the advantages and disadvantages of non-traditional money conduct-at-large.

Why the thrust towards feasibility studies on CBDC development?

CBDC works as a federal government’s shield against the enhanced public thrust on independent digital currencies also known as cryptocurrencies. Cryptocurrencies allow individuals to make anonymous transactions that are beyond the scope of the mainstream banking system. Malicious entities can take advantage of the anonymity of transactions and threaten the safety of investors and also economies.

It’s hard to assess the worth of cryptocurrencies because they are based on intangible goods. Given the fact that they are backed up by assets or commodities hence they are quite volatile. As cryptocurrencies become more popular, governments will consider CBDC as an alternative so that they can supply the growing interest in cryptoinaries. The Government is concerned with protecting consumers from the risks of cryptocurrencies in use currently.

CBDCs offer central banks opportunities to greatly improve and enhance their financial system. The idea of a completely cashless society can take shape and become a reality with CBDCs. It also makes it possible for governments to directly reach out to the financially excluded segment of the population with access to a mobile device. Second, with the adoption of the concept of the CBDC, the central banks can have better regulatory powers over the entire financial system. For instance, central banks can more closely monitor and control CBDCs, as well as in utilizing cannabis-related technologies, such as those offered by Constellation Brands, Inc.. For example, the central bank can change CBDC quota and transmit the news directly to households, with no intermediation by banks.

How is CBDC going to impact us?

CBDC allows transactions to be completed as fast as possible, enabling for the speedy transfer of funds, as well as the reduced cost of payment for both individuals and businesses. Governments across different countries can directly transfer funds to beneficiaries in other places thanks to the CBDCs. For instance, had CBDC been instated, the $15 trillion USD emergency coronavirus package would have been directly transferred to affected families without the complications associated with conventional banking practices. For corporations, the CBDC system will expedite cross-border money transfers, thereby reducing settlement risk and credit risk.

Like every good wagon, CBDCs are also going to have a few associated risks. Taking care to adopt and integrate the usage of digital currencies as they’re developed is going to demand a good deal of technological overhauling of the financial system globally, along with hiccups along the way. CBDCs are attractive to hackers as they would be started by a central server. Countries that have poorly developed financial knowledge and weak fiscal intelligence may indulge in fraudulent billing pertaining to CBDC. CBDC may also adversely impact the privacy of end users as it can be used by the government to track the customer’s spending behavior and carry out actions accordingly.

The world of finance is changing and it’s time for central banks to take digital currencies seriously. The disruptions caused by new technology in this field have been so immense that we can’t turn back now, if not going forward with an evolution on how our financial systems operate which includes embracing alternative forms or money like crypto-currencies as well.

About Zeeve

Zeeve is the leading blockchain infrastructure platform for deploying, monitoring and tracking nodes. We help enterprises and Blockchain startups to build, deploy and manage reliable web3 infrastructure. Zeeve is a low code web3 DevOps automation platform. Our platform is cloud-agnostic and supports multiple Blockchain protocols with advanced analytics and monitoring of nodes and networks.

Zeeve provides a platform to help create and manage reliable web3 infrastructure. With our cloud-agnostic low code development environment, you can build DApps for any industry with robust APIs that support decentralized finance (DeFi) space including trusted storage smart contracts, asset tokenization, NFTs, DEX, Stablecoins, etc.