During 2020 and 2021, scalability and high gas costs were a prominent issue in the blockchain space, especially on the Ethereum network due to the accelerated growth of DeFi applications. The surge in this activity put immense pressure on the network, causing congestion and skyrocketing gas prices. Simple transactions on the network became expensive, discouraging other users from interacting with DeFi applications.

The issue progressively led to the development of traditional Layer2 scaling solutions like Polygon, Arbitrum, and Optimism, which significantly solved the issues while leveraging the security of Ethereum to scale DeFi, with just $58B in market cap.

But when you want to power-up Real-World Assets, where, if only one segment is getting tokenized. I.e. real -estate, an estimated $617 T market cap will be on blockchain, imagine what would unfold when other vectors like arts, bonds, golds and others enter the space. You need a technology to answer to the call of scalability, security, privacy and decentralization that ZK Stack for Tokenized RWAs promises. Why is it an effective solution to help RWAs overcome their existing bottlenecks? Let’s find that out;

Why is ZKSync’s ZK Stack is Best For launching Elastic Chains for Tokenized RWAs?

The adoption of RWAs faces significant challenges because of scalability issues and lack of diversification of assets. Besides, compliance and the need for interoperability with existing financial systems raises another issue.

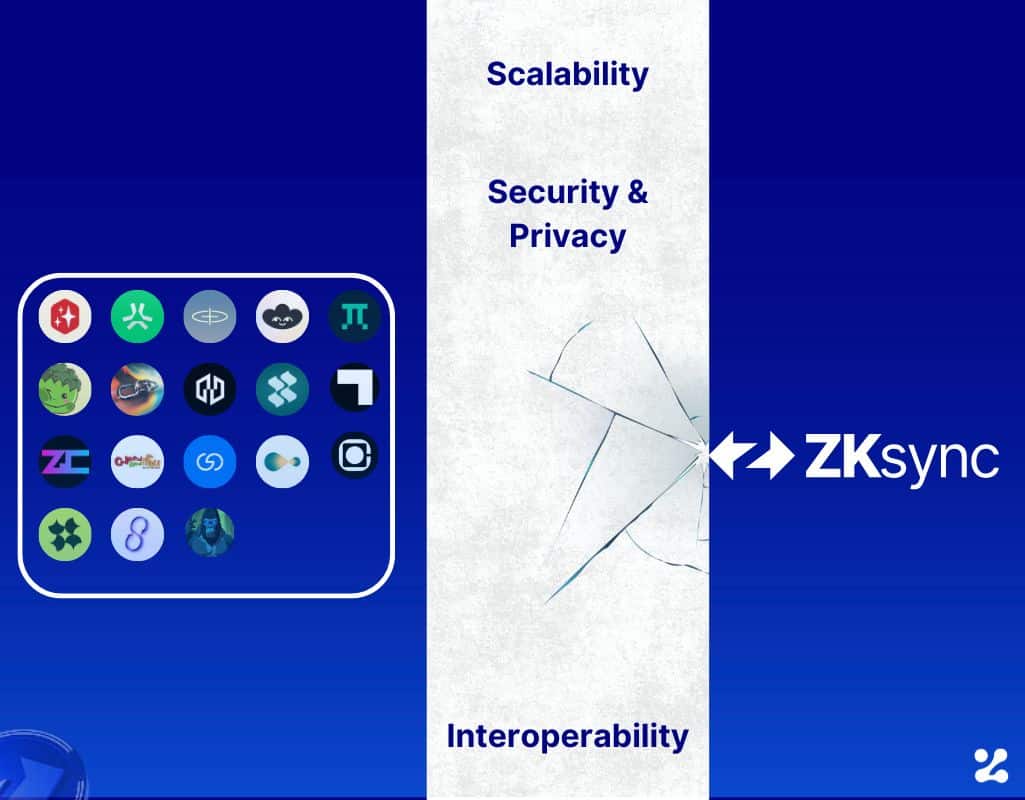

ZKsync Elastic Chains powered by ZKstack aims to do something different in the world of asset tokenization. The issue of tokenizing RWAs on a blockchain usually lies on three blockchain pillars – scalability, security, and interoperability. ZK Stack for Tokenized RWAs solves this in the given ways;

Scalability

Tokenized RWA ecosystems process thousands of transactions at once, which could increase significantly during peak activity. The speed at which these transactions are executed is essential to user experience and performance.

ZKsync Elastic Chains are designed to handle high throughput and accommodate a growing number of participants. Unlike traditional blockchains, Elastic Chains dynamically scale up or down based on network demand, ensuring consistent performance during peak activity.

For instance, a tokenized real estate marketplace can process thousands of transactions, including fractional ownership transfers, without experiencing delays or exorbitant gas fees. ZK Stack for Tokenized RWAs are incredibly flexible to allow RWAs to do more transactions without significantly affecting performance.

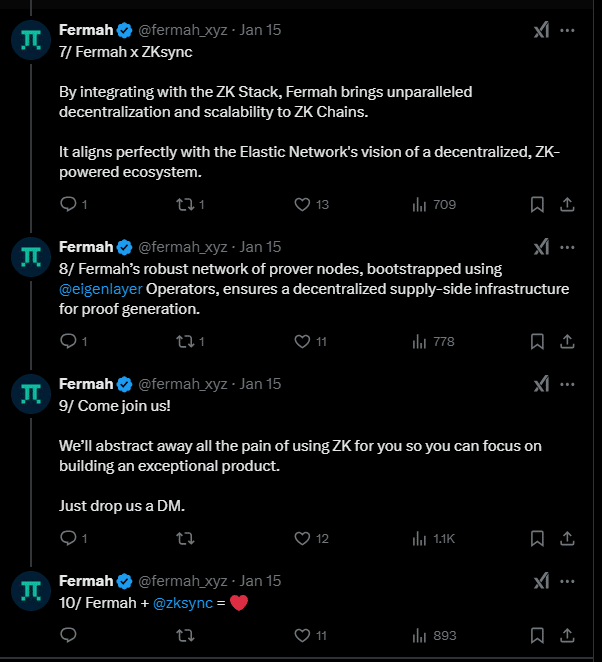

Fermah, the platform for creating ZK proofs, has said in its tweet, appreciating the Elastic Network of ZKsync, and explained how it will bring robust decentralization and eliminate the headache of managing proof generation infrastructure. Moreover since the Elastic Chains are highly interoperable, it would allow Fermah to process proof generation beyond just one chain specific domain and give developers more room to concentrate on improving their products instead of building proof generation systems for their application.

Security and Privacy

Security and privacy, according to the CEO of Matter Labs and the Founder of ZKsync- Alex Gluchowski- remains a top priority for institutions exploring tokenized RWAs. This was captured in his tweets below where he submitted that financial institutions do care about security, credible neutrality, and privacy.

— ALEX | ZK ∎ (@gluk64) January 24, 2025

ZK-Rollups, the backbone of ZKsync Elastic Chains, provide a robust security layer. By bundling transactions and validating them with Zero-Knowledge Proofs, ZKsync ensures transaction integrity while minimizing computational overhead.

While regulatory uncertainties are still evident, ZKstack’s compliance-friendly design ensures adaptability to various and current legal frameworks from all jurisdictions. This is to ensure that users’ data are always protected. That’s why Lens Protocol chose ZK Stack because it is helping bundle all the interaction, posts and users as a single variable proof which can be easily validated without putting the privacy of users at stake.

Moreover, through ZK Stack’s Elastic Chain, it was also possible to create custom layers and still remain connected with the larger Zk ecosystem. That’s why ZK Stack for Tokenized RWAs breaks all the ice when you are seeking a reliable stack for building your RWA project.

Security is non-negotiable for tokenized RWAs. With Zeeve RaaS, launch a secure ZKsync Elastic Chain while focusing on compliance & privacy.

Interoperability

The siloed structure of blockchains has been a significant issue in the ecosystem, preventing an interconnected financial ecosystem. Tokenized RWAs thrive in ecosystems where they can interact with multiple platforms, blockchains, and DeFi applications.

The good news is with ZK Stack for Tokenized RWAs, blockchains become interoperable, enabling RWAs to seamlessly integrate with Ethereum, other Layer 2 solutions, and even traditional financial systems. For example, tokenized bonds issued on a ZKsync Elastic Chain can be traded on decentralized exchanges or used as collateral in DeFi protocols, creating new avenues for liquidity.

By all means, implementing Zk Stack’s Elastic Chains requires technical expertise, which could pose a barrier. However, ZKstack is poised to eliminate this barrier by providing developer tools and resources to simplify the onboarding process. This is to make sure that the adoption of Elastic Chains for tokenized RWAs is not without challenges.

Alex G. reiterated the team’s focus on making the blockchain solution the best for developers to build on his X account. This is a testament to ZKsync’s commitment to make the onboarding process easier and make RWAs adoption straightforward for everyone.

Over the past year, we’ve been hard at work making ZKsync the best place for developers to build. From powerful new tools to deeper integrations, here’s how we’ve transformed the developer experience 🛠️ pic.twitter.com/PzkqgBHg1e

— ZKsync Developers (∎, ∆) (@zkSyncDevs) January 24, 2025

Therefore, it was no surprise that it has 26% market share, according to RWA.xyz, only behind Ethereum in the top networks for tokenized RWAs.

Moreover, ZKsync’s total value of its 27 tokenized assets amounted to $1.78 billion. This means one thing – ZK Stack for Tokenized RWAs goes without an iota of doubt. Furthermore, it is also evident that ZKstack is leading the pack in TVL growth due to RWA adoption as shown in the image below. This is evident in the statistics released by Layer2 Insider, where ZKsync recorded an impressive 15.06% in TVL growth in one week, the highest among the top 10 Layer2s.

🔥 BULLISH:

— Layer2 Insider (@layer2_insider) January 24, 2025

🚀📈 Check out the top 10 Layer2s with the impressive TVL growth in just 7 days:

🥇 @zksync: 15.06%

🥈 @arbitrum: 4.83%

🥉 @base: 3.88%

.@modenetwork: 3.00%

.@MetisL2: 2.34%

.@Mint_Blockchain: 2.21%

.@world_chain_: 1.11%

.@Mantle_Official: 1.07%

.@LineaBuild: 1.00%… pic.twitter.com/aXluuemMl3

Due to these tradeoffs, Tradable, the platform integrating private credits in DeFi resonates with ZK Stack for Tokenized RWAs because through ZK Stack’s Elastic Chain(s), Tradable could access a wider ecosystem and use the privacy, interoperability and security of ZK Stack to pursue their vision of scalability with security.

Build Your ZKsync Elastic Chain with Zeeve

So can ZKstack deliver the best elastic chains for tokenized RWAs? It’s an absolute yes. ZK Stack for Tokenized RWAs addresses the major issues plaguing the adoption of tokenized RWAs. The potential of ZKstack to deliver the best Elastic Chains for tokenized RWAs lies in its ability to address scalability, security, and interoperability. As pointed out here, ZKstack Elastic Chains addresses these fundamental factors, which makes the blockchain solution ready to onboard users into the world of tokenized assets. Its tailored solutions for tokenized RWAs promise to unlock new levels of efficiency and accessibility for real-world assets in the Web3 era.

Zeeve Rollups-as-a-Service introduces the necessary tooling and support that you need to deploy your own ZKsync Elastic Chain using the ZK Stack. By using the Sandbox tools for ZKsync Elastic Chains, you can build your own custom ZK Chain(s) with all the necessary ZKsync updates for Elastic Chains. You can even cut the time to market for your project when you have Zeeve to help you.