Powered by blockchain technology, Decentralized Finance (DeFi) has emerged as a sweeping wave of innovation facilitating highly liquid and interoperable financial services without a centralized intermediary.

DeFi users can gain permission-less access to highly liquid products such as loans, insurance, payments, margin trading, and more while holding custody all the while. In March 2022, there are $83 billion in smart contracts’ total value locked in the DeFi. Compared to conventional finance, DeFi allows lower entry barriers to financial markets, unprecedented transparency, and better competitive offerings for financial products.

It will be perfectly alright to term DeFi a decentralized application environment providing a new dimension to the financial ecosystem. DeFi achieves this by replacing intermediaries (banks– for example) with self-execution technology (smart contracts) to reduce cost, bring agility and increase liquidity while offering almost full ownership controls to the investors.

Smart contracts – the nerve center of DeFi

Smart contracts, used as an underlying technology by DeFi, are self-executing contractual agreements written in computer languages. The conventional contract terms are embedded into the code, and these automatically execute when the required conditions are met. To ensure the verifiability of transactions, a permanent copy is saved on the relevant Blockchain ledger that can be verified on any net-enabled device by community members.

Built on the principles suggested by Nick Szabo, an eminent computer scientist, and cryptographer, smart contracts are about embedding contractual clauses, regardless of their nature, format, and purpose, into software designed to facilitate the easy execution of valid transactions. Smart contracts discourage any sort of breaching or fraud by making it restrictively complicated.

These automated contracts act as a base for auto-executing value exchange between parties where human trust is to be replaced by predictable if-then processes.

Role of stablecoins in DeFi

Stablecoins are cryptocurrencies with value hooked to a specific reference or assets like gold, euros, and dollars. These are further divided into fiat/asset-backed, crypto-collateralized, and algorithmic stablecoins. The Fiat/asset-backed stablecoins are tethered at the ratio of 1:1 by a private entity asset.

For instance, Tether is one such stablecoin backed 1:1 by US dollars. Cryptocollaterized tokens refer to stablecoins tethered to other Blockchain cryptocurrencies. For example, DAI is collateralized using other cryptocurrencies. Algorithmic stablecoins use algorithmic mechanisms related to buying/selling reference assets to achieve value.

Termed the backbone of DeFi, stablecoins enable investors to generate yield on their funds while using DeFi protocols, while setting aside the potential adverse effects of market volatility. For instance, if an investor places ETH as collateral, it carries a risk as the price of ETH may dive down. Using stablecoin, however, eliminates any such risk.

Multiple advantages

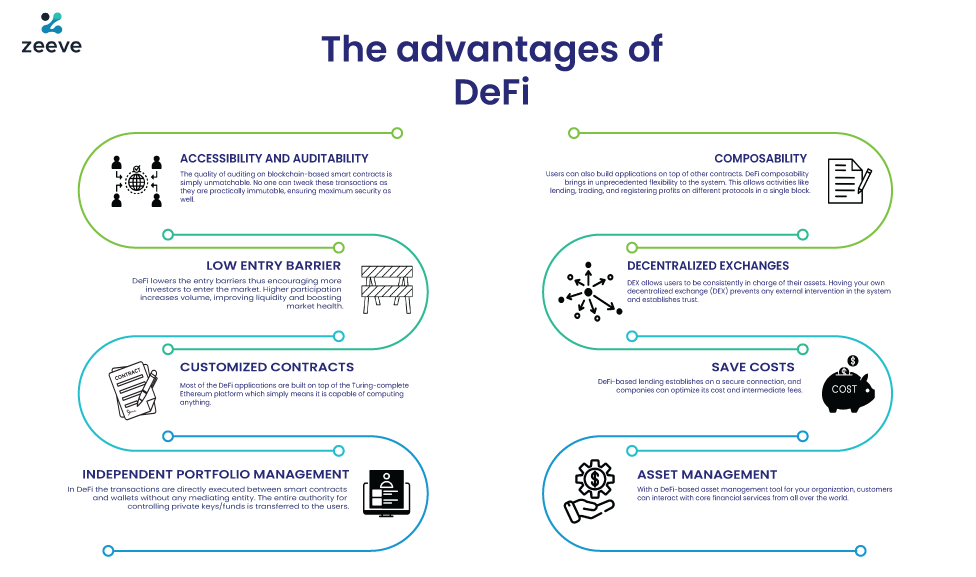

Riding its innovative concept of decentralized financial transactions, DeFi rolls out a string of advantages:

Accessibility and auditability

As a decentralized system that is open to the general public, transactions are executed by smart contracts and are accessible to any interested entity. Its code, present on an open public ledger, allows members to trace the history and public addresses of the transactions. The quality of auditing on blockchain-based smart contracts is simply unmatchable. No one can tweak these transactions as they are practically immutable, ensuring maximum security as well.

Low entry barrier

A trustless ecosystem without any need for mediators has enabled DeFi to eliminate complex prerequisites, and formalities and demolish money barriers. Conventionally, issues like jurisdiction, license, know-your-customer (KYC), and others are associated with the conventional capital securities market. DeFi lowers the entry barriers thus encouraging more investors to enter the market. Higher participation increases volume, improving liquidity and boosting market health.

Customized contracts

Most of the DeFi applications are built on top of the Turing-complete Ethereum platform which simply means it is capable of computing anything. Interpreting in general terms, one can write their own subjective ownership rules, formats, and transition rules. Depending on your objectives, you can create customized business logic.

Independent portfolio management

In DeFi the transactions are directly executed between smart contracts and wallets without any mediating entity. The entire authority for controlling private keys/funds is transferred to the users. It allows them to fully personalize their investment portfolio.

Composability

Users can also build applications on top of other contracts. DeFi composability brings unprecedented flexibility to the system. This allows activities like lending, trading, and registering profits on different protocols in a single block.

Various DeFi Use Cases

Going ahead than creating better alternatives to traditional financial practices, DeFi has also promoted innovations like synthetic assets. Here are some prominent use cases of DeFi, creating a new frontier of finance technology.

P2P lending/borrowing

One of the most popular DeFi use cases is P2P lending and borrowing of assets without the need for a bank account, paperwork, or review process. It even frees the borrower from the most stressful task – finding someone who is willing to lend!

In the DeFi ecosystem, you can borrow the required amount directly from smart contracts, provided you fulfil the parameters required, and the interest is automatically adjusted depending upon the demand-supply. Along with saving time and effort, DeFi-based lending and borrowing also take complexity and guesswork out of the process.

On one hand, this use case of DeFi allows borrowers easy funds, while on the other, it enables people with surplus funds to earn interest on their passive crypto assets.

Fractionalization of costs

DeFi facilitates asset tokenization which reduces the costs of investment, speeds up transactions, and increases security. For instance, it empowers investors with financial or geographic limitations to participate in global real asset opportunities. After the costs get fractionalized, it becomes easier for anyone to invest. Compared to traditional financial methods, it provides people with a more accessible and affordable alternative to invest.

Greater asset control

Contrary to the conventional financial system that has designated authorities such as banks or trading agencies, DeFi allows you to take custody of your funds. It is the only system currently making you the sole custodian of the capital investment. The decentralized system empowers you to distribute, rotate and adjust your funds for the best return potential. Such control was simply missing in erstwhile centralized ones.

Autonomous organizations without central authority

DeFi acts as an enabler to establish DAOs (Decentralized Autonomous Organizations) where hierarchical management is replaced by self-governing protocols with provisions for automated execution. These self-enforcing protocols guide the group of people to cooperate with one another in a specific manner to achieve the objectives of the organization. The mechanism distributes the control directly among the shareholders, eliminating the need for central custodians/management.

Create custom derivatives

Derivatives are contracts tethered to underlying entities like index interest rates or assets. The performance of these underlying entities determines the value of derivatives. Generally, these platforms allow you to create assets by depositing collateral to maintain your position. Synthetix is a well-known derivatives platform on the Ethereum blockchain.

Decentralized exchanges

DEXs (decentralized exchanges) refer to a self-operating and decentralized cryptocurrency exchange that acts without any mediator or central authority. Unlike centralized systems, buyers or sellers are able to trade without ceding control over their funds to any intermediary. DEXs work on the basis of on-chain or off-chain order books.

Yield aggregators

In the economy of yield farming, the yield aggregators play a central role by strategically leveraging various protocols of DeFi. This helps users immensely in increasing their profits. They lock up or pledge the funds and offer a return on investment, which could be either fixed or variable.

Yield aggregators pool deposits together and simplify the experience of yield farming. Once yield aggregators come into the picture, users’ role becomes limited to deposits and withdrawals. The rest of the process, from interest accrual to selling the farmed rewards, is executed by the yield aggregator.

These use cases are meant to brief you about DeFi and are not the end certainly. There are many more DeFi applications with unique use cases, such as prediction markets, insurance, margin trading, payments, staking, and many more.

Challenges to the DeFi ecosystem

Like any ecosystem, DeFi too has its own set of challenges:

- Unaudited code in smart contracts is the foremost challenge DeFi faces, creating gaps that are used for exploitation leading to capital loss and even protocol failure.

- There is also a possibility of collateral-backed protocols using the system to manipulate liquidation.

- DeFi protocols’ dependence on Oracle for off-chain information enables hackers to try and manoeuvre the oracles to their advantage to create a profitable scenario.

- Ethereum is the most popular blockchain regarding protocols that collectively create the DeFi ecosystem. However, the Ethereum network often becomes congested, resulting in exorbitant gas fees and constraining the speed of transactions.

DeFi Reshaping Fintech

Defi is taking Fintech to a new level and is providing many possibilities. Fintech provides people with an array of financial services such as — payments, digital wallets, loans, investments, B2B services, B2C and much more. DeFi allows similar financial services in the form of cryptocurrencies. The DeFi are reshaping the fintech rather than disrupting it.

Fintech companies need to understand that the investors are not willing to pay a big amount fee to intermediaries. Thus, there will be a shift towards the decentralized network “blockchain”. While the fintech foundation is bureaucracy DeFi’s foundation is low bureaucracy and trustlessness. Both systems have their own set of problems. However, merging traditional finance with DeFi will be helpful in the longer run.

Wrapping up

Despite being a new entrant, the technology has garnered billions and continues to attract users. It has sustained itself for a considerably long period, belittling the camp that thought of DeFi as just another bubble. As technology grows and matures, DeFi is set to evolve as well.

Zeeve Tokenization Service

Zeeve is the leading Blockchain as a Service platform helping enterprises and Blockchain startups build, deploy and manage reliable decentralized apps and Blockchain networks. Zeeve is a low code automation platform that is cloud agnostic and supports multiple Blockchain protocols with advance analytics and monitoring of nodes and networks. Zeeve features a powerful set of APIs to build DApps for plethora of use cases across industries. Zeeve supports Decentralized Finance (DeFi) space with decentralized storage, trusted nodes and smart contracts. For more details, schedule a free call with our DeFi specialist.