As a viable layer-2 scaling solution, blockchain rollups offer a range of benefits for DeFi. Whether you are building DeFi apps from scratch or aiming to enhance the existing capabilities of your DeFi platform, launching a rollup-powered L2/L3 or sovereign chain is an ideal option. To further emphasize the importance of rollups in DeFi, this article explains the top rollup use cases for DeFi. Our entire analysis will help DeFi enterprises, projects, and independent developers understand how rollup infrastructure can transform their ecosystem and unlock a range of benefits.

Why Rollup Infrastructure for DeFi?

Rollups are advantageous for the DeFi in many ways, such as adding massive scalability to dApps, ensuring the privacy of sensitive finance-related data, protecting against MEV exploitation and enabling interoperability across siloed systems. Optimistic and zkRollups are currently the feasible options for launching rollups.

And, if we talk about flexibility—- DeFi projects can choose to either build smart contract rollups or sovereign rollups, whatever is required. If you want to learn more about smart contract rollups vs sovereign rollups, refer to our detailed guide linked below:

A Comprehensive Guide for Smart Contract and Sovereign Rollups

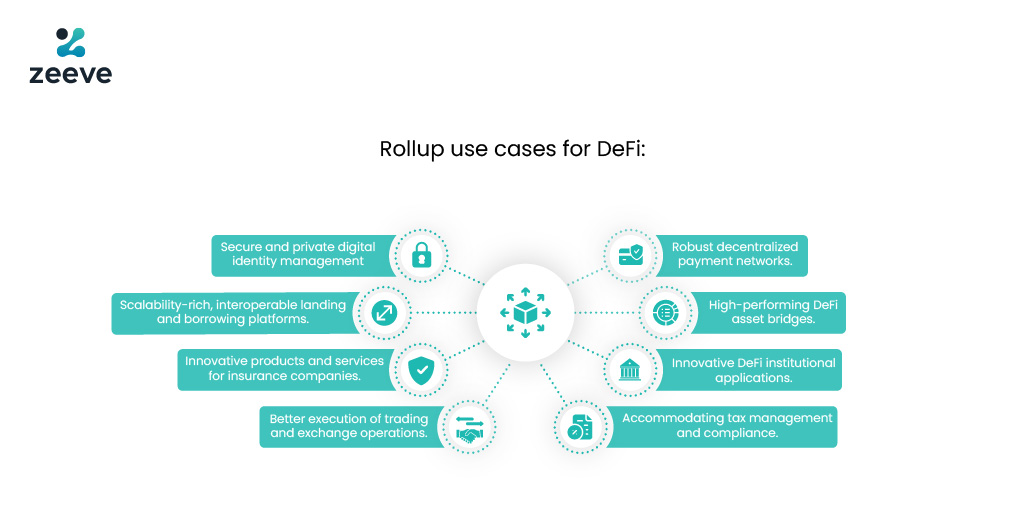

Let’s explore the main Rollup use cases for DeFi

1- Secure and private digital identity management:

DeFi exchanges, prediction markets, DAOs, or anything— these projects manage and authenticate individuals’ identities in a purely decentralized manner. Still, at the same time, they are required to ensure data privacy. Achieving such a level of privacy-enabled digital identity management is possible by launching a rollup chain tailored with very specific data privacy features, keeping the information accessible to only authorized parties.

A real-world example is Worldcoin– a trusted platform for digital identity and finance is set to bring two of its products, World ID and World App, on independent ‘Superchains’ built with OP Stack by Optimism. With this launch, Worldcoin aims to make the following vision a reality:

- Launch of a powerful, privacy-first identity network on OP Mainnet.

- Having the capability to handle 8,00,000 daily transactions.

- Inclusion of EIP-4844 to reduce Layer-2 fees by 10x.

- Migrating its digital currencies and stablecoins for better utility and liquidity.

2- Scalability-rich, interoperable landing and borrowing platforms:

Decentralized or DeFi lending and borrowing platforms have gained huge traction among investors and lenders as they bridge the gap between traditional finance and DeFi borrowing. However, with the growing number of users, these platforms may face issues like slow processing of transactions, slow confirmation, and high gas fees during congestion periods.

Fortunately, blockchain rollups– whether Optimistic or zkRollups are optimized to eliminate all the issues from existing DeFi lending and borrowing platforms, ensuring a highly secure, high-performance, and easily customizable ecosystem.

Speaking about real-world applications, Aave– the popular DeFi lending platform with a TVL of over $8.5 billion will be deploying an upgraded version of its protocol called v3 on a Layer-2 network, Metis Andromeda powered with Optimistic Rollup technology. This major upgrade will unlock benefits for Aave, like enhanced liquidity and userbase, speeding up its throughput capacity, reduced gas cost, increased transaction speed, inter-chain interoperability, and an enhanced user experience.

Another example is Canto Public, a general-purpose, permissionless DeFi-focused blockchain building a Zk-powered modular layer-2 with Polygon CDK. The migration is intended to leverage the unified liquidity from Polygon and Ethereum, permissionless security & sovereignty, and most importantly– increased throughput.

3- Innovative products and services for insurance companies:

Blockchain has removed significant tradeoffs from insurance processes, such as eliminating frauds, safe storage of policy & claim data, and non-compliance with regulations. However, the need for end-to-end transparency and data privacy is still a concern. With rollups, insurance companies can launch a single-use chain for a variety of purposes like:

- Validation of authenticity, ownership of assets, provenance, and validity of policy-related data.

- Ensuring the security of sensitive data such as Social Security numbers (SSN), Federal tax ID, and employer identification numbers (EIN).

- Keeping the ecosystem private while maintaining communication with other public insurance services to exchange data and value. This is done securely via native rollup bridges, for example- Polygon zkEVM bridge, Optimism Bridge, Hyperbridges, and more, without compromising security.

Tidal Finance (Polygon), Insured Finance (Polygon), and InsureDAO (Optimism) are some of the popular DeFi insurance platforms that are currently running on Layer-2 public chain, but they may consider launching a separate roll-up chain for massive scalability, customizations, and cross-platform interoperability.

4- Better execution of trading and exchange operations:

Decentralized exchanges uphold a significant portion of the DeFi market. But, as we know, DEXs with millions of daily active users and fast-growing userbase are prone to certain challenges. Let’s take the example of Uniswap– it has a live TVL of $4,010.10 billion and all-time trading volume of $1.789 Trillion. Managing such a huge ecosystem on a single layer may cause issues like slow throughput speed, high waiting time, and lack of interoperability with other DEXs and protocols.

Adding a Layer-2 rollup to Layer-1 is the one-stop solution to all these challenges. That’s because rollup allow exchanges to adopt new-age technologies like Automated Market Maker (AMM), native bridges, ERC-4337 for Account Abstraction, and the flexibility to launch multi-rollups (layer-3 on the top of layer-2) for endless scalability.

For real-world applications, let’s talk about OKX, IDE, and Syndr. OKX is launching a EVM-compatible OKX’s native network– X1 with Polygon CDK framework. The chain will allow web3 projects to build their modular rollup with benefits like interoperability with Polygon’s broader ecosystem, custom tokenomics, extremely lower gas fees, zero latency, and a lot more.

IDEX is also using Polygon CDK to build XCHAIN dedicated– a dedicated Layer-2 for gas-free settlement, deposits, and settlement-related security from Ethereum, flexibility to interoperate with other DEXs, on-chain custody and fast settlement, seamless integration and liquidity access with Polygon 2.0’s attributes. XCHAIN is basically v3 of IDEX which will introduce exciting features and 10,000x cheaper transactions than IDEX v2.

Talking about Syndr, this decentralized exchange is building its Synchr chain powered by Arbitrum Orbit, aiming to have an app-specific Layer3 rollup, unparalleled security rooted on Ethereum, 1-click on/off-boarding, inter-chain interoperability, Zero gas fees and high performance, and 1-click on/off-boarding. With all these features, Syndr plans to grow its user base to 100M by the end of 2023.

5- Robust decentralized payment networks:

A decentralized payment network is one of the leading use cases of DeFi that is being adopted rapidly by government bodies, central banks, and commercial banks. However, the payment network may face certain challenges when traffic exceeds a certain threshold. Challenges range from declining security to slower transactions, high transaction fees, and downtime. Launching a layer-2 rollup means any payment network has shifted most of its load (transaction computation) on a separate chain and gets security from L1. This way, the network will experience up to 10x faster transactions, lower cost, end-to-end security, and excellent data availability for zero downtime.

A real-world example is Gnosis Pay— a reliable decentralized payment network that leverages Polygon zkEVM rollup infrastructure for operating its Gnosis card– the world’s first self-custodial visa card. With that, Gnosis Pay offers the following features:

- Accommodating massive transactions.

- Self-custodial approach.

- 0.00% fees for new users.

- Certified and secure ecosystem.

- Complete EVM-support.

6- High-performing DeFi asset bridges:

DeFi, or decentralized asset bridge, is an integral component that facilitates communication, data, and asset flow between two independent blockchain networks. But we can’t overlook the security risks associated with cross-chain bridges. For example, if a bridge connects 10 different ecosystems and one of these protocols comes across an attack, the security of the nine will be at risk.

Knowing this, Zk Rollups offers a highly secure infrastructure for building trustless bridges that are protected with Layer-1’s security and cryptographic proofs that enable safe and fraud-proof communication between L1, L2, and other rollup chains.

Regarding real-world application, Axelar is a popular DeFi asset bridge built using OP Stack. Axelar connects dozens of chains like Ethereum, Avalanche, Polygon, BNB, and more with guaranteed security of assets and Turing-complete composability. General message passing and Universal asset transfer are the two main features of Axelar that have been increasing its adoption in the web3 space.

7- Innovative DeFi institutional applications :

Rollup infrastructure enables DeFi enterprises to experiment with rollup stacks and build customized institutional applications to cater to their use case-specific needs. For example, a DAO can use rollup infrastructure to build a highly popular Layer-2 for managing on-chain governance. Here, the DAO can add special privacy parameters to the network, choose data availability methods & sequencer type, and configure the gas fee as required. Further, rollup infrastructure will offer next-level features like censorship resistance, full control on enabling accessibility permission, reliable security from layer 1, and more.

Binance and Coinbase are the top examples of institutions adopting rollup infrastructure for scaling their ecosystems. Coinbase has launched its own rollup chain, Base, which is built using OP Stack. Base is open source, protected with Ethreum’s security, and have tried and tested features such as the option to set up gasless transactions, account abstraction, easy-to-use bridges, and most importantly, a highly modular ecosystem for building rollup-agnostic superchains.

Binance, on the other hand, has integrated two powerful rollups into its ecosystem– zkBNB and opBNB to achieve its vision of increasing the block gas limit to 300M and increasing the TPS to 5,000. Rollups will further help Binance boost security, get full decentralization, and maintain uninterrupted communication with various L2s.

8- Accommodating tax management and compliance:

Tax management and compliance are last ones, but vital rollup use cases for DeFi. While tax administrations have already adopted blockchain technology to become more digital and automated, they continue to face challenges like limited visibility in supplychain and information systems, real-time data traceability, interoperability, and slow processing of tax returns.

With rollups, government agencies can launch a fully customized, sovereign rollup, a modular blockchain to accommodate their specific needs, such as processing tax applications with all the regulatory compliance. If a requirement changes, multiple rollups can be launched to serve different purposes, and all the rollups can seamlessly interoperate with each other via the bridges/ interoperability layer.

Launch your L2/L3 and Sovereign rollups easily with Zeeve

Zeeve offers one-click deployment of rollups for all kinds of web3 enterprises, startups, and independent projects, enabling them to build their custom rollup chains– be it sovereign or smart contract rollup. Zeeve supports OP Stack, Arbitrum Orbit, Polygon CDK, and zkStack frameworks. With our Polygon CDK Sandbox, you can launch your zkRollup chain in a few clicks. Sandbox for zkSync Hyperchains and Arbitrum Orbit will be live soon.

All the pain of launching a rollup chain will be taken away, whether it’s about deploying nodes, managing components such as bridges, explorers, data indexers, faucets, or wallets ready, and monitoring & upgrade of the underlying infrastructure. This ensures seamless rollup launch and, therefore, faster time-to-market.

Further, Zeeve ensures enterprise-grade security and 99.9% uptime with enterprise-level SLA. To know more about how Zeeve simplifies rollup launch, you can connect with our web3 experts through email and one-to-one calls for detailed discussion.