The financial landscape is undergoing a significant transformation as institutional investors recognize the immense potential of cryptocurrencies.

According to a recent survey conducted among Chief Financial Officers (CFOs) from 100 global hedge funds, a remarkable trend has emerged. It is projected that by 2026, approximately 7.2% of their holdings will be allocated to cryptocurrencies, representing a staggering monetary value of around $312 billion. While lending and borrowing strategies have their appeal, a significant portion of these investments is expected to flow into the practice of staking.

The data further supports this, with Ethereum 2.0 staking alone forecasted to surpass $40 billion by 2025. Interestingly, institutional investors are actively exploring the possibilities of leveraging staking rewards to fund startup projects, highlighting the broader potential for capital allocation within the blockchain staking ecosystem.

As we delve into this article, we will take an in-depth look at the emerging trend of institutional staking, uncover its advantages, analyze its implications for Proof-of-Stake (PoS) blockchains, and explore the diverse opportunities that lie ahead in this exciting and rapidly evolving landscape.

Staking In a Nutshell

Staking is a fundamental feature of Proof-of-Stake (PoS) blockchains that empowers token holders with an opportunity to actively participate in network security. Unlike the traditional Proof-of-Work (PoW) model that relies on miners solving complex mathematical puzzles, staking operates through a different mechanism.

In staking, one entity known as validators, commit their assets to validate transactions and propose new blocks in the blockchain. The selection of validators could be based on various factors, including the number of tokens staked, the duration of staking, etc.

By staking their tokens, participants contribute to the network’s security and integrity. They can run their own node, pledge to a staking pool delegating tokens, and choose liquid staking. In return, they earn rewards in the form of the native cryptocurrency for their valuable contribution.

To become a validator, one needs to run a Validator node for that specific blockchain, fulfilling specific requirements in terms of hardware, number of tokens staked, duration of staking etc.

Learn more on this: Everything You Need to Know About Validator Nodes: A Deep Dive

How Does Staking Work?

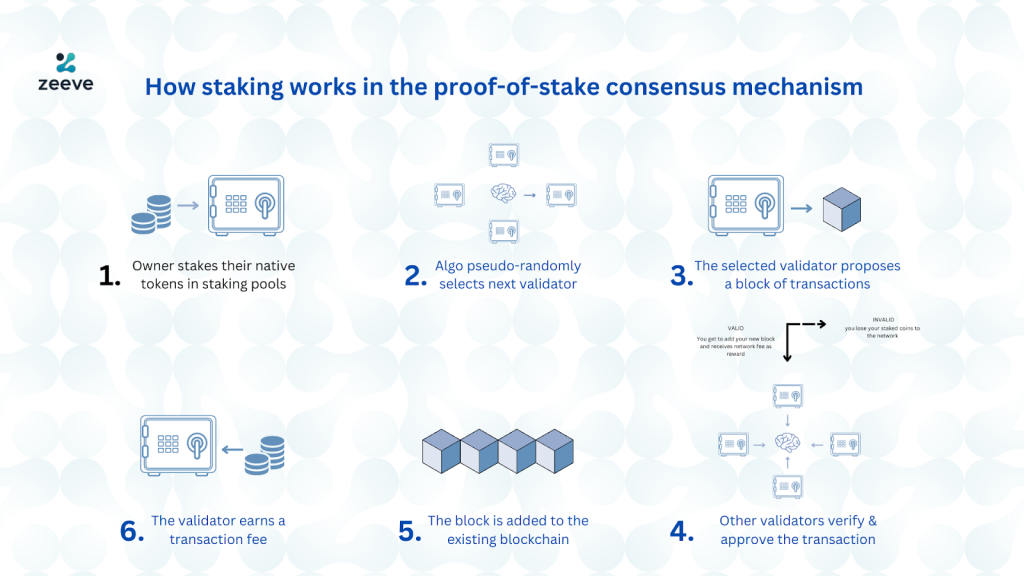

In a Proof-of-Stake (PoS) blockchain, the staking process involves token owners staking their tokens in staking pools or individually to participate in network consensus and earn rewards. When the time comes to select the next validator, the PoS algorithm employs a pseudo-random selection method to choose the validator responsible for proposing a new block of transactions.

The selected validator proposes a block of transactions and broadcasts it to the network. Other validators then independently validate and verify the proposed block to ensure its correctness and compliance with the blockchain’s rules. If the block is deemed valid, it is added to the existing blockchain, advancing the chain’s history.

The validator who successfully proposed the block receives block rewards, usually in the form of additional cryptos. However, if a validator acts maliciously or proposes invalid blocks, they may face penalties, which can include the loss of a portion or all of their staked tokens.

Now, this malicious behaviour could be intentional, or could be unintentional also. We will discuss about this in detail in our next blog on ‘Mitigating Risks in Institutional Staking”

How Institutional staking differ from traditional staking?

Institutional staking stands apart from normal staking most retail investors familiar with due to its unique characteristics and requirements. Though there are no difference from the blockchain side itself, their needs and requirements makes all the difference.

Unlike reatil investors, institutional staking involves the active participation of large organizations such as banks, hedge funds, and asset management firms. These institutions often engage in staking at a much larger scale, which can significantly impact network dynamics and the distribution of rewards.

Institutional stakers may also rely on custodial services and maintain complex infrastructure to facilitate staking across multiple blockchains. Moreover, institutions must adhere to specific compliance requirements and implement rigorous risk management protocols, adding an additional layer of complexity to their staking activities.

These factors make institutional staking distinct, reflecting the tailored needs and considerations of large-scale organizations in their pursuit of engaging with staking within the blockchain ecosystem.

Why Institutional Staking Is Growing?

Institutional staking is experiencing a significant rise in popularity, driven by multiple factors that make it an appealing choice for institutions and corporate investors seeking alternative investment options.

One primary driver is the low returns observed in traditional investments, particularly in the bond market. Macroeconomic factors have dwindled in the past couple of years. As a result of that, bond markets have entered the bearish cycle. As per Bloomberg Global Aggregate Total Index, the yields from bonds have fallen by a considerable 20%. Such sharp declines have made investors feel as if they are back to the 1960’s and 70s.

AA/AAA rated bonds in various countries such as the US, UK, Germany, and Japan offer relatively low yields, compelling investors to explore new avenues. Crypto assets have emerged as a top choice, providing unprecedented returns and serving as a safe investment haven amidst macroeconomic fluctuations.

Furthermore, institutional staking presents an effective hedge against inflationary pressures. Unlike bonds that generate meager or negative yields when adjusted for inflation, staking offers returns ranging from 6% to 7% across staking pools, allowing investors to protect and grow their assets.

The compounding effect is another compelling factor that attracts institutional stakers. By reinvesting rewards and earning interest on the new principal amount, staking enables the exponential growth of investments over time.

Additionally, staking does not require investors to give up or lend out their assets, ensuring complete control and custody of tokens. This feature distinguishes staking from other yield generation methods that involve potential risks and uncertainties. For example, to earn yield on platforms like Aave or Compound, investors must physically give up their tokens to borrowers, without a guarantee of receiving the full principal back. In contrast, staking enables all tokens to remain in self-custody.

Top PoS Blockchains & their Rewards:

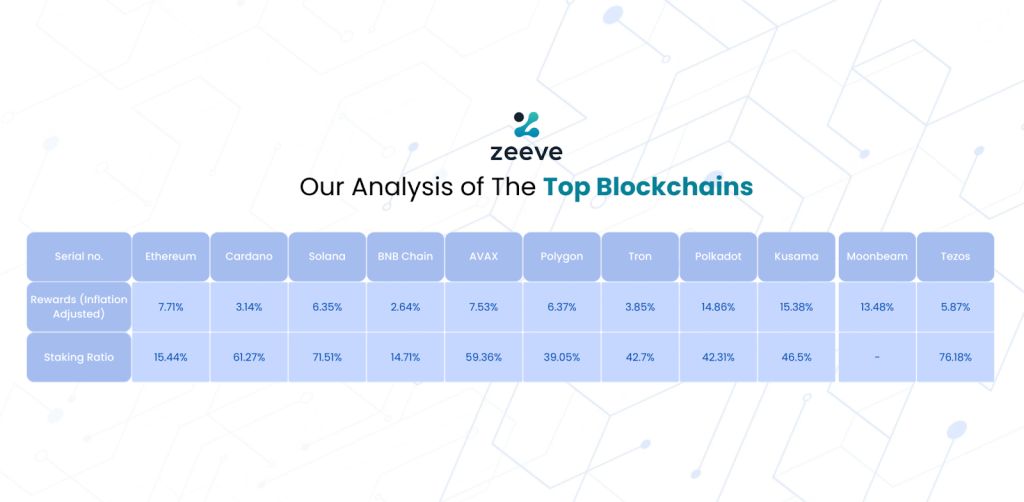

Unlike traditional investments managed by specialized fund managers, these rewards are not dependent on discretionary decision-making. Instead, they are derived from two primary sources: protocol-specified rewards and a portion of the transactional fees paid by users seeking to have their transactions included in the network.

The specific amount of rewards and fees received by validators may fluctuate based on transparent rules. Generally, as the number of validators decreases, rewards tend to increase, while an increase in demand for blockspace leads to higher transactional fees.

The chart accompanying this information provides insights into the inflation-adjusted rewards and staking ratio for the top PoS blockchains. Staking Ratio means the total % of coins that are staked currently out of the total supply of tokens.

Conclusion

In conclusion, this article has provided a comprehensive overview of institutional staking, covering its definition, functioning, popular PoS blockchains and rewards. We have explored the reasons behind the rise of institutional staking, driven by low returns in traditional investments and the potential for better returns through staking.

However, one must be mindful of the loopholes at the same time when undertaking staking. It is essential to recognize that institutional staking also carries certain risks, which will be addressed in the next article. We will delve into strategies for mitigating these risks, available options for institutional investors, and a practical guide to getting started with institutional staking.

By equipping institutions with the necessary knowledge and insights, the upcoming article aims to empower them to make informed decisions and capitalize on the opportunities presented by staking in the blockchain ecosystem.